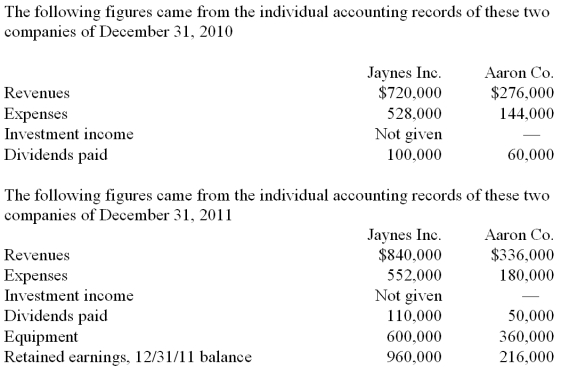

Jaynes Inc. acquired all of Aaron Co.'s common stock on January 1, 2010, by issuing 11,000 shares of $1 par value common stock. Jaynes' shares had a $17 per share fair value. On that date, Aaron reported a net book value of $120,000. However, its equipment (with a five-year remaining life) was undervalued by $6,000 in the company's accounting records. Any excess of consideration transferred over fair value of assets and liabilities is assigned to an unrecorded patent to be amortized over ten years.

-What balance would Jaynes' Investment in Aaron Co. account have shown on December 31, 2010, when the equity method was applied for this acquisition?

Definitions:

Prisoners' Dilemma

The prisoners' dilemma is a standard example of a game analyzed in game theory that shows why two completely rational individuals might not cooperate, even if it appears that it is in their best interests to do so.

Tit-for-tat Strategy

A strategy in game theory where a participant replicates the opponent's previous action, often used in conflict resolution or competitive situations.

Repeated Play

In game theory, it refers to situations where the same game is played multiple times by the same participants, potentially leading to different strategies based on past outcomes.

Resale Price Maintenance

A practice whereby manufacturers dictate the minimum prices retailers can charge for their products.

Q2: Bauerly Co. owned 70% of the voting

Q3: If newly issued debt is issued from

Q12: How are intra-entity inventory transfers treated on

Q75: What amount of goodwill should be attributed

Q80: Suppose k grows at a rate

Q93: Compute the book value of Vega at

Q97: In the consolidation worksheet for 2011, assuming

Q104: In 2012, government transfer payments accounted for

Q107: How much goodwill is associated with this

Q113: Gaw Company owns 15% of the common