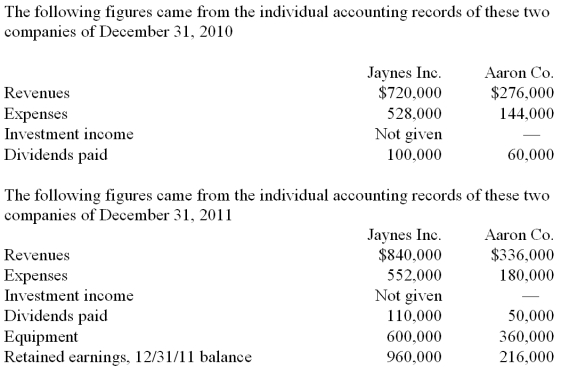

Jaynes Inc. acquired all of Aaron Co.'s common stock on January 1, 2010, by issuing 11,000 shares of $1 par value common stock. Jaynes' shares had a $17 per share fair value. On that date, Aaron reported a net book value of $120,000. However, its equipment (with a five-year remaining life) was undervalued by $6,000 in the company's accounting records. Any excess of consideration transferred over fair value of assets and liabilities is assigned to an unrecorded patent to be amortized over ten years.

-What was consolidated net income for the year ended December 31, 2011?

Definitions:

ABC Method

A prioritization technique where tasks are categorized into three groups (A, B, and C) according to their importance and urgency.

Innovative Thinker

An individual who introduces new ideas and approaches, demonstrating creativity and original thinking in problem-solving.

Four-Temperament Profile

A theory suggesting that there are four basic personality types, often used in psychology to categorize human behavior.

Director

A person who is in charge of an organization, department, or production, guiding how a vision is realized.

Q4: Parrett Corp. acquired one hundred percent of

Q10: According to the expenditure approach to GDP,

Q24: In consolidation at December 31, 2011, what

Q25: Select True (T) or False (F) for

Q28: What is the Equity in Howell Income

Q33: In 1960, approximately _ of the world's

Q58: In the consolidation worksheet for 2011, which

Q68: Compute the noncontrolling interest in Demers at

Q82: For consolidation purposes, what net debit or

Q93: If per capita GDP in 2013 was