On January 1, 2009, Rand Corp. issued shares of its common stock to acquire all of the outstanding common stock of Spaulding Inc. Spaulding's book value was only $140,000 at the time, but Rand issued 12,000 shares having a par value of $1 per share and a fair value of $20 per share. Rand was willing to convey these shares because it felt that buildings (ten-year life) were undervalued on Spaulding's records by $60,000 while equipment (five-year life) was undervalued by $25,000. Any consideration transferred over fair value of identified net assets acquired is assigned to goodwill.

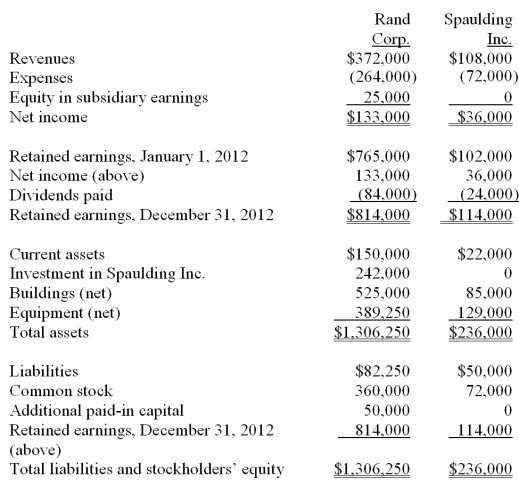

Following are the individual financial records for these two companies for the year ended December 31, 2012.

Required:

Prepare a consolidation worksheet for this business combination.

Definitions:

Melanie Klein

A psychoanalyst known for her work on object relations theory and the psychoanalysis of children, highlighting the importance of early emotional relationships.

Freud

Refers to Sigmund Freud, the founding father of psychoanalysis, a method for treating psychopathology through dialogue between a patient and a psychoanalyst.

Freudian Defense Mechanism

Psychological strategies used unconsciously by individuals to protect themselves from anxiety and internal conflicts, as proposed by Sigmund Freud.

Behaviorally Oriented

Focused on or pertaining to observable and measurable actions or reactions, often in the context of psychology or behavior therapy.

Q60: Assume that both Japan's and the United

Q62: If Smith's net income is $100,000 in

Q74: The noncontrolling interest's share of the earnings

Q82: Net exports are also called:<br>A) capital outflows<br>B)

Q91: Compute the noncontrolling interest in the net

Q91: Each of the following is a benefit

Q101: Compute consolidated goodwill at the date of

Q104: Jet Corp. acquired all of the outstanding

Q105: For an acquisition when the subsidiary retains

Q106: How does a gain on an intra-entity