Figure:

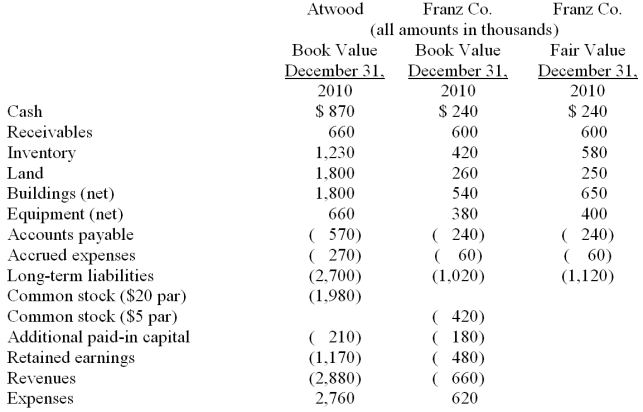

Presented below are the financial balances for the Atwood Company and the Franz Company as of December 31, 2010, immediately before Atwood acquired Franz. Also included are the fair values for Franz Company's net assets at that date.  Note: Parenthesis indicate a credit balance

Note: Parenthesis indicate a credit balance

Assume a business combination took place at December 31, 2010. Atwood issued 50 shares of its common stock with a fair value of $35 per share for all of the outstanding common shares of Franz. Stock issuance costs of $15 (in thousands) and direct costs of $10 (in thousands) were paid to effect this acquisition transaction. To settle a difference of opinion regarding Franz's fair value, Atwood promises to pay an additional $5.2 (in thousands) to the former owners if Franz's earnings exceed a certain sum during the next year. Given the probability of the required contingency payment and utilizing a 4% discount rate, the expected present value of the contingency is $5 (in thousands) .

-Compute consolidated inventory at date of acquisition.

Definitions:

Marginal Benefits

The additional advantage or gain derived from receiving or consuming one additional unit of a product or service.

Marginal Costs

The added cost involved in producing another unit of a product or service.

Fiscal Impact

The effect of government spending and tax policies on the economy, including changes in revenue, expenditure, and debt levels.

Illegal Immigration

The act of moving to a country in violation of its immigration laws, often to seek work, shelter, or higher quality of life.

Q1: Which of the following does macroeconomics endeavor

Q23: Compute Wilson's share of income from Simon

Q28: In 2012, government expenditures accounted for about

Q41: One of the nice properties of the

Q42: Which one of the following varies between

Q43: When a subsidiary is acquired sometime after

Q76: Which adjustment would be made to change

Q84: What was the balance in the Investment

Q85: An intra-entity sale took place whereby the

Q113: Compute the noncontrolling interest in Demers at