Figure:

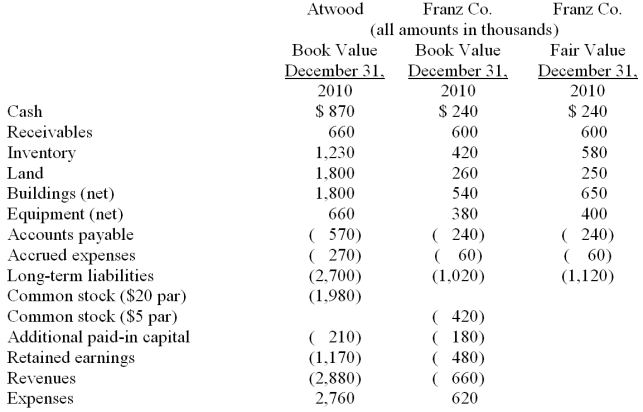

Presented below are the financial balances for the Atwood Company and the Franz Company as of December 31, 2010, immediately before Atwood acquired Franz. Also included are the fair values for Franz Company's net assets at that date.  Note: Parenthesis indicate a credit balance

Note: Parenthesis indicate a credit balance

Assume a business combination took place at December 31, 2010. Atwood issued 50 shares of its common stock with a fair value of $35 per share for all of the outstanding common shares of Franz. Stock issuance costs of $15 (in thousands) and direct costs of $10 (in thousands) were paid to effect this acquisition transaction. To settle a difference of opinion regarding Franz's fair value, Atwood promises to pay an additional $5.2 (in thousands) to the former owners if Franz's earnings exceed a certain sum during the next year. Given the probability of the required contingency payment and utilizing a 4% discount rate, the expected present value of the contingency is $5 (in thousands) .

-Compute consolidated goodwill at date of acquisition.

Definitions:

European Union

A political and economic union of 27 European countries that are tied by common policies covering a wide range of areas, including trade, security, and law.

Common Fiscal Policy

A coordinated approach by multiple governments or entities to manage tax policies, government spending, and public debt to influence economic conditions.

Tariffs and Quotas

Government-imposed regulations where tariffs are taxes on imported goods, and quotas are limits on the amount of a product that can be imported.

Smoot-Hawley Tariff Act

Legislation passed in 1930 that established very high tariffs. Its objective was to reduce imports and stimulate the domestic economy, but it resulted only in retaliatory tariffs by other nations.

Q4: Which one of the following is a

Q16: What amount will be reported for consolidated

Q21: For 2011, what is the total amount

Q34: If the population of Romania was about

Q39: If the parent's net income reflected use

Q65: On January 1, 2011, Bangle Company purchased

Q68: The growth rate of any variable

Q85: Each of the following is a benefit

Q96: Since about _, U.S. expenditure shares by

Q107: How much goodwill is associated with this