Figure:

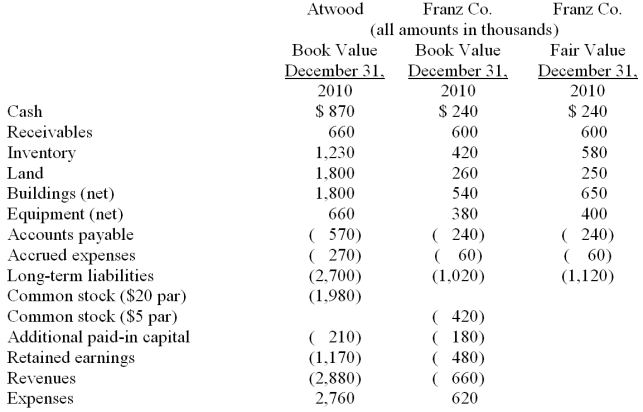

Presented below are the financial balances for the Atwood Company and the Franz Company as of December 31, 2010, immediately before Atwood acquired Franz. Also included are the fair values for Franz Company's net assets at that date.  Note: Parenthesis indicate a credit balance

Note: Parenthesis indicate a credit balance

Assume a business combination took place at December 31, 2010. Atwood issued 50 shares of its common stock with a fair value of $35 per share for all of the outstanding common shares of Franz. Stock issuance costs of $15 (in thousands) and direct costs of $10 (in thousands) were paid to effect this acquisition transaction. To settle a difference of opinion regarding Franz's fair value, Atwood promises to pay an additional $5.2 (in thousands) to the former owners if Franz's earnings exceed a certain sum during the next year. Given the probability of the required contingency payment and utilizing a 4% discount rate, the expected present value of the contingency is $5 (in thousands) .

-Compute consolidated equipment at date of acquisition.

Definitions:

Direct Costs

Expenses that are directly attributed to the production of goods or services, such as materials and labor.

Territory

An area or region designated for specific business activities or responsibilities, often defined for sales purposes.

Corporate Customers

Business entities or organizations that purchase goods or services for their operational needs, as opposed to individual consumers.

Segment

A group of people or organizations sharing one or more characteristics that cause them to have similar product needs.

Q12: Compute the amount of consolidated land at

Q32: To get an accurate view of how

Q41: Compute consolidated cost of goods sold.<br>A) $7,500,000.<br>B)

Q54: Determine consolidated Additional paid-in Capital at December

Q60: In Figure 4.4, MPL represents the

Q63: What is meant by unrealized inventory gains,

Q68: If push-down accounting is not used, what

Q94: Push-down accounting is concerned with the<br>A) impact

Q106: At the date of acquisition, by how

Q107: Prepare a proper presentation of consolidated net