Figure:

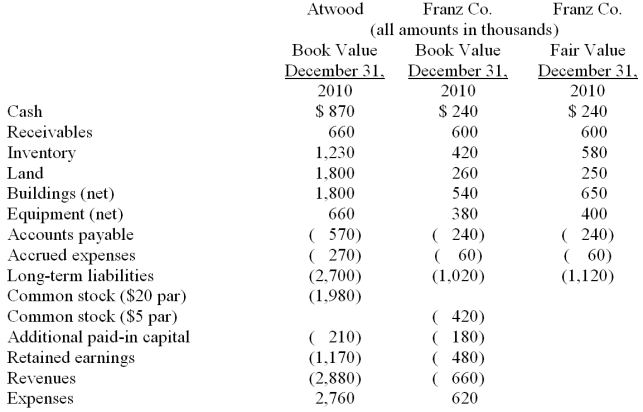

Presented below are the financial balances for the Atwood Company and the Franz Company as of December 31, 2010, immediately before Atwood acquired Franz. Also included are the fair values for Franz Company's net assets at that date.  Note: Parenthesis indicate a credit balance

Note: Parenthesis indicate a credit balance

Assume a business combination took place at December 31, 2010. Atwood issued 50 shares of its common stock with a fair value of $35 per share for all of the outstanding common shares of Franz. Stock issuance costs of $15 (in thousands) and direct costs of $10 (in thousands) were paid to effect this acquisition transaction. To settle a difference of opinion regarding Franz's fair value, Atwood promises to pay an additional $5.2 (in thousands) to the former owners if Franz's earnings exceed a certain sum during the next year. Given the probability of the required contingency payment and utilizing a 4% discount rate, the expected present value of the contingency is $5 (in thousands) .

-Compute consolidated revenues at date of acquisition.

Definitions:

Actualization

The process of realizing or achieving one’s potential or self-fulfillment, often associated with Maslow's hierarchy of needs.

Unconditional Positive Regard

The complete acceptance and support of a client by a therapist, regardless of what the client says or does, fostering an environment of safety and trust.

Transference

The redirection of feelings and desires, especially those unconsciously retained from childhood, toward a new object, often the therapist in psychotherapy.

Client-Therapist Relationship

The professional and therapeutic bond between a therapist and their client, which is critical for effective therapy, emphasizing trust, rapport, and mutual respect.

Q21: Nominal gross domestic product is defined as:<br>A)

Q31: Parent Corporation acquired some of its subsidiary's

Q66: During January 2010, Wells, Inc. acquired 30%

Q71: Suppose there are L<sub>0</sub> people in

Q76: Define <span class="ql-formula" data-value="Y =

Q80: In 2012, the U.S. GDP was about

Q86: For an acquisition when the subsidiary retains

Q101: Compute Parker's reported gain or loss relating

Q101: The law of diminishing marginal product to

Q120: Compute the December 31, 2013 consolidated retained