Figure:

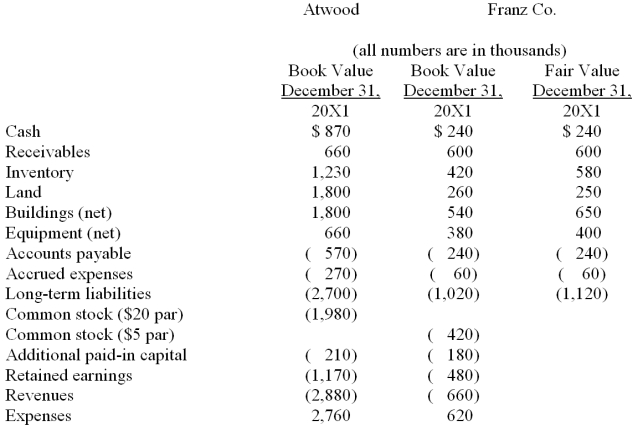

The financial balances for the Atwood Company and the Franz Company as of December 31, 20X1, are presented below. Also included are the fair values for Franz Company's net assets.  Note: Parenthesis indicate a credit balance

Note: Parenthesis indicate a credit balance

Assume an acquisition business combination took place at December 31, 20X1. Atwood issued 50 shares of its common stock with a fair value of $35 per share for all of the outstanding common shares of Franz. Stock issuance costs of $15 (in thousands) and direct costs of $10 (in thousands) were paid.

-Compute consolidated revenues at the date of the acquisition.

Definitions:

Numerical Amount

A quantity or value expressed in numbers.

Written Amount

The value of a document or instrument stated in words.

Five And 62/100

A manner to express the numeric value 5.62, often found in financial documents.

Cash Money

Physical money in the form of banknotes and coins, as opposed to electronic or digital forms of currency.

Q15: What is the total amount of excess

Q21: Net cash flow from operating activities was:<br>A)

Q44: What is the primary objective of the

Q57: The National Income and Product Accounts

Q66: Parent Corporation recently acquired some of its

Q71: When a parent uses the initial value

Q78: When Ryan's new percent ownership is rounded

Q90: Nominal GDP is given by _, where

Q100: Compute the equity in earnings of Gargiulo

Q107: How much difference would there have been