Figure:

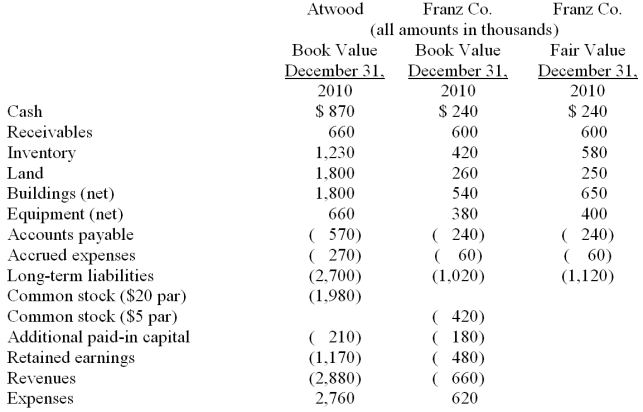

Presented below are the financial balances for the Atwood Company and the Franz Company as of December 31, 2010, immediately before Atwood acquired Franz. Also included are the fair values for Franz Company's net assets at that date.  Note: Parenthesis indicate a credit balance

Note: Parenthesis indicate a credit balance

Assume a business combination took place at December 31, 2010. Atwood issued 50 shares of its common stock with a fair value of $35 per share for all of the outstanding common shares of Franz. Stock issuance costs of $15 (in thousands) and direct costs of $10 (in thousands) were paid to effect this acquisition transaction. To settle a difference of opinion regarding Franz's fair value, Atwood promises to pay an additional $5.2 (in thousands) to the former owners if Franz's earnings exceed a certain sum during the next year. Given the probability of the required contingency payment and utilizing a 4% discount rate, the expected present value of the contingency is $5 (in thousands) .

-Compute consolidated inventory at date of acquisition.

Definitions:

Lessee's Equity Cash Flows

This refers to the cash flows that a lessee obtains which directly affect their equity, usually through operations or transactions related to leased assets.

Capital Budgeting Project

The process of planning and managing a company's long-term investments in projects and assets.

Lessee's Debt Cash Flows

This term pertains to the cash flows related to the debt a lessee incurs, typically in the context of financing leases, showing how lease expenses affect the lessee's overall financial situation.

Residual Value

The market value of the leased property at the expiration of the lease. The estimate of the residual value is one of the key elements in lease analysis.

Q1: Compute the equity in earnings of Gargiulo

Q32: Which of the following statements is true

Q38: Consider Table 2.3. Using the Paasche index,

Q38: How much does Pell record as Income

Q40: What amount will be reported for consolidated

Q41: Compute Pell's investment in Demers at December

Q64: The following account balances are for the

Q67: Allen Co. held 80% of the common

Q74: You are a staff economist for

Q108: Compute the noncontrolling interest in Gargiulo's net