Figure:

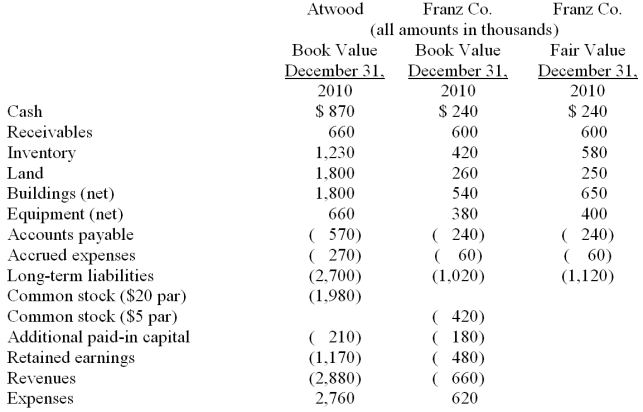

Presented below are the financial balances for the Atwood Company and the Franz Company as of December 31, 2010, immediately before Atwood acquired Franz. Also included are the fair values for Franz Company's net assets at that date.  Note: Parenthesis indicate a credit balance

Note: Parenthesis indicate a credit balance

Assume a business combination took place at December 31, 2010. Atwood issued 50 shares of its common stock with a fair value of $35 per share for all of the outstanding common shares of Franz. Stock issuance costs of $15 (in thousands) and direct costs of $10 (in thousands) were paid to effect this acquisition transaction. To settle a difference of opinion regarding Franz's fair value, Atwood promises to pay an additional $5.2 (in thousands) to the former owners if Franz's earnings exceed a certain sum during the next year. Given the probability of the required contingency payment and utilizing a 4% discount rate, the expected present value of the contingency is $5 (in thousands) .

-Compute consolidated buildings (net) at date of acquisition.

Definitions:

Bank Reconciliation

Bank reconciliation is the process of matching and comparing the balances in an entity’s accounting records for a cash account to the corresponding information on a bank statement.

Deposits In Transit

Refers to cash and checks that have been received and recorded by an entity but have not yet been deposited in the bank account.

Bank Reconciliation

The process of matching and comparing figures from the accounting records against those presented on a bank statement to see if they are consistent.

Company Books

Official records maintained by a business documenting its financial transactions and activities.

Q9: What is the consolidated total of noncontrolling

Q14: How much goodwill is associated with this

Q22: What is the controlling interest share of

Q23: Compute Wilson's share of income from Simon

Q40: In models with perfect competition:<br>A) economic profits

Q41: Compute consolidated cost of goods sold.<br>A) $7,500,000.<br>B)

Q51: Compute the amount of Hurley's inventory that

Q73: What amount will be reported for consolidated

Q94: Prepare journal entries for Virginia and Stateside

Q111: As an economist working at the