Figure:

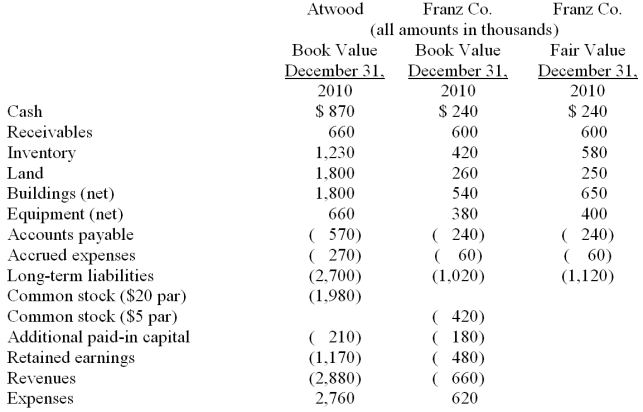

Presented below are the financial balances for the Atwood Company and the Franz Company as of December 31, 2010, immediately before Atwood acquired Franz. Also included are the fair values for Franz Company's net assets at that date.  Note: Parenthesis indicate a credit balance

Note: Parenthesis indicate a credit balance

Assume a business combination took place at December 31, 2010. Atwood issued 50 shares of its common stock with a fair value of $35 per share for all of the outstanding common shares of Franz. Stock issuance costs of $15 (in thousands) and direct costs of $10 (in thousands) were paid to effect this acquisition transaction. To settle a difference of opinion regarding Franz's fair value, Atwood promises to pay an additional $5.2 (in thousands) to the former owners if Franz's earnings exceed a certain sum during the next year. Given the probability of the required contingency payment and utilizing a 4% discount rate, the expected present value of the contingency is $5 (in thousands) .

-Compute consolidated goodwill at date of acquisition.

Definitions:

Reasonable Means

Utilizing practical and rational methods or measures when performing tasks or solving problems, aiming for effectiveness with efficiency.

Mode of Communication

The method or process by which information is conveyed between individuals or groups, such as verbal, written, or non-verbal communication.

Mailbox Rule

is a legal principle that an offer, acceptance, or any other form of legal communication is considered effective once it is dispatched, not when it is received.

Rebate

A partial refund given to someone who has paid too much for tax, rent, or a utility.

Q7: In the Cobb-Douglas production function

Q32: For each of the following numbered situations

Q42: Which one of the following varies between

Q72: At what amount will Inkblot be reflected

Q78: In consolidation, the total amount of expenses

Q82: Prevatt, Inc. owns 80% of Franklin Company.

Q88: In 1960, approximately _ of the world's

Q89: On April 7, 2011, Pate Corp. sold

Q95: Which of the following statements is false

Q102: If the parent's net income reflected use