Figure:

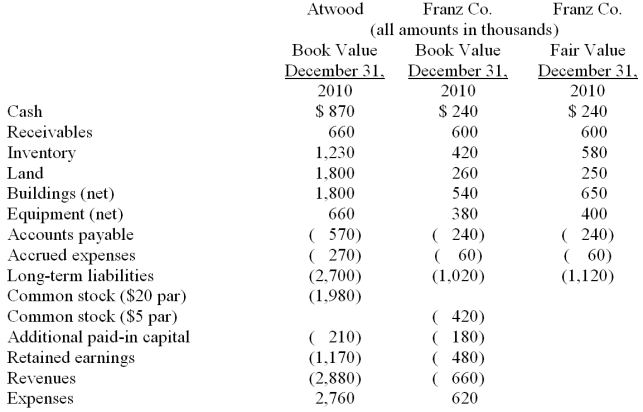

Presented below are the financial balances for the Atwood Company and the Franz Company as of December 31, 2010, immediately before Atwood acquired Franz. Also included are the fair values for Franz Company's net assets at that date.  Note: Parenthesis indicate a credit balance

Note: Parenthesis indicate a credit balance

Assume a business combination took place at December 31, 2010. Atwood issued 50 shares of its common stock with a fair value of $35 per share for all of the outstanding common shares of Franz. Stock issuance costs of $15 (in thousands) and direct costs of $10 (in thousands) were paid to effect this acquisition transaction. To settle a difference of opinion regarding Franz's fair value, Atwood promises to pay an additional $5.2 (in thousands) to the former owners if Franz's earnings exceed a certain sum during the next year. Given the probability of the required contingency payment and utilizing a 4% discount rate, the expected present value of the contingency is $5 (in thousands) .

-Compute consolidated equipment at date of acquisition.

Definitions:

Task-Oriented Goals

Specific targets focused on completing a task efficiently and effectively, often used to measure performance and productivity.

Relations-Oriented Goals

Objectives that focus on enhancing interpersonal relationships and teamwork.

Effective Teams

Groups of individuals who work together efficiently and productively, achieving goals through coordination, communication, and mutual support.

Relations-Oriented Behavior

Behavior that prioritizes and values the development and maintenance of positive interpersonal relationships.

Q7: In 1950, per capita real GDP in

Q19: What is the excess amortization for 2011

Q22: What is the controlling interest share of

Q23: The costs of economic growth include which

Q30: When we look at the _ we

Q63: When consolidating a subsidiary under the equity

Q66: Parent Corporation recently acquired some of its

Q93: Compute the book value of Vega at

Q98: The production function <span class="ql-formula"

Q106: A variable interest entity can take all