Figure:

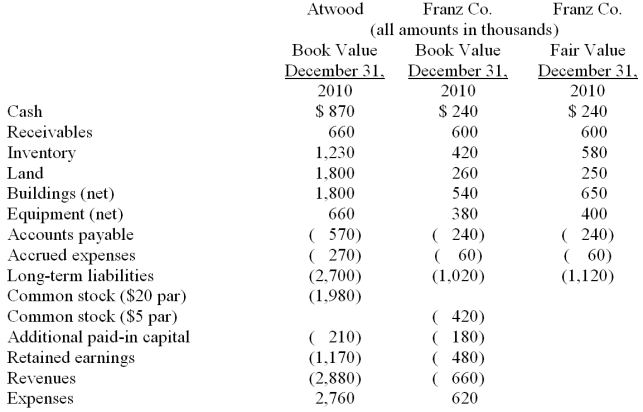

Presented below are the financial balances for the Atwood Company and the Franz Company as of December 31, 2010, immediately before Atwood acquired Franz. Also included are the fair values for Franz Company's net assets at that date.  Note: Parenthesis indicate a credit balance

Note: Parenthesis indicate a credit balance

Assume a business combination took place at December 31, 2010. Atwood issued 50 shares of its common stock with a fair value of $35 per share for all of the outstanding common shares of Franz. Stock issuance costs of $15 (in thousands) and direct costs of $10 (in thousands) were paid to effect this acquisition transaction. To settle a difference of opinion regarding Franz's fair value, Atwood promises to pay an additional $5.2 (in thousands) to the former owners if Franz's earnings exceed a certain sum during the next year. Given the probability of the required contingency payment and utilizing a 4% discount rate, the expected present value of the contingency is $5 (in thousands) .

-Compute consolidated revenues at date of acquisition.

Definitions:

Expensive Application

Refers to software programs that have a high purchase or subscription price.

Laptop's Browser

The web browsing software installed on a laptop computer.

Cloud Computing

The delivery of computing services over the internet, including servers, storage, databases, networking, software, analytics, and intelligence, to offer faster innovation, flexible resources, and economies of scale.

Remotely Collaborate

The act of working with others from different locations using digital tools and platforms.

Q5: Which of the following statements is true

Q21: The following equation is an example

Q28: Name three of the fastest growing countries

Q33: In the consolidation worksheet for 2010, which

Q39: Suppose we calculate the percent change in

Q42: Assuming the current rate of economic growth

Q55: One of the key characteristics of the

Q82: Compute the consolidated liabilities at December 31,

Q121: Yukon Co. acquired 75% percent of the

Q127: In the year 2007, total factor productivity