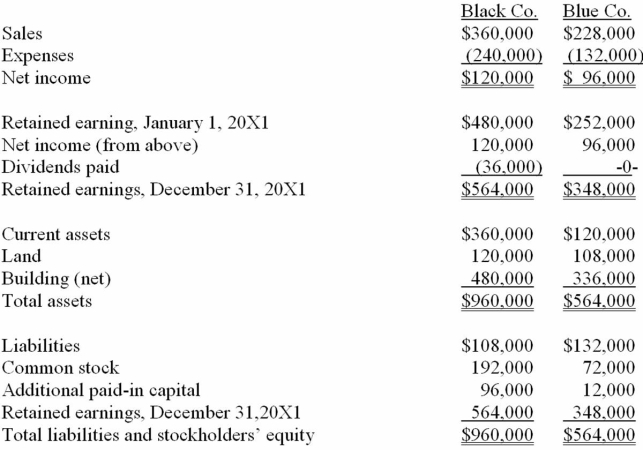

The following are preliminary financial statements for Black Co. and Blue Co. for the year ending December 31, 20X1.

On December 31, 20X1 (subsequent to the preceding statements), Black exchanged 10,000 shares of its $10 par value common stock for all of the outstanding shares of Blue. Black's stock on that date has a fair value of $50 per share. Black was willing to issue 10,000 shares of stock because Blue's land was appraised at $204,000. Black also paid $14,000 to several attorneys and accountants who assisted in creating this combination.

Required: Assuming that these two companies retained their separate legal identities, prepare a consolidation worksheet as of December 31, 20X1 assuming the transaction is treated as a purchase combination.

Definitions:

Q6: Consider Table 2.1, which tabulates GDP for

Q13: Red Co. acquired 100% of Green, Inc.

Q34: In the income approach to GDP, fixed

Q61: Suppose k and l grow at

Q66: Compute income from Stiller on Leo's books

Q76: Compute income from Stark reported on Parker's

Q77: Keefe, Inc., a calendar-year corporation, acquires

Q78: Mathematically, an economic model is:<br>A) a fake

Q94: MacHeath Inc. bought 60% of the outstanding

Q104: A company has been using the equity