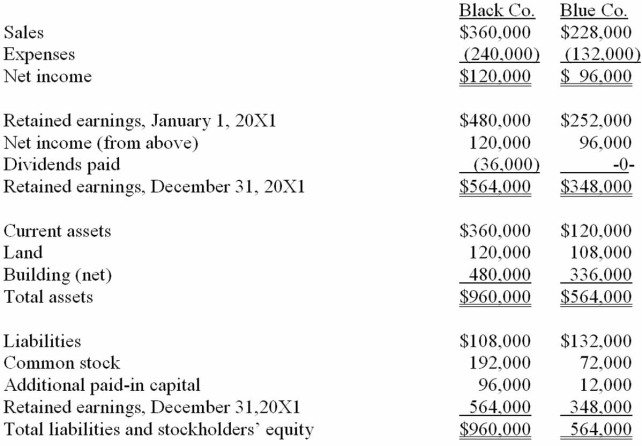

The following are preliminary financial statements for Black Co. and Blue Co. for the year ending December 31, 20X1 prior to Black's acquisition of Blue.

On December 31, 20X1 (subsequent to the preceding statements), Black exchanged 10,000 shares of its $10 par value common stock for all of the outstanding shares of Blue. Black's stock on that date has a fair value of $60 per share. Black was willing to issue 10,000 shares of stock because Blue's land was appraised at $204,000. Black also paid $14,000 to several attorneys and accountants who assisted in creating this combination.

Required: Assuming that these two companies retained their separate legal identities, prepare a consolidation worksheet as of December 31, 20X1 after the acquisition transaction is completed.

Definitions:

Aggregate Demand

The holistic demand for goods and services throughout an economy, estimated at a predetermined price level over a particular period.

Active Approach

A proactive strategy in management or policy-making that involves taking deliberate actions to achieve specific goals.

Aggregate Supply

The sum total of products and services that corporations in an economic system plan to offer for sale during a given time frame.

Recessionary Gap

A situation where an economy's real GDP is lower than its potential GDP, leading to unemployment and underutilized resources.

Q9: Consider the data in Table 2.4. The

Q12: If MPL < w, the firm:<br>A) has

Q14: What is the amount of consolidated net

Q31: English philosopher Thomas Hobbes is notable for

Q34: What are the steps macroeconomists use to

Q52: What was the balance in the Investment

Q58: Compute the consolidated additional paid-in capital at

Q59: Polar sold a building to Icecap on

Q62: Suppose k, l, and A grow

Q78: What is the balance in Cale's investment