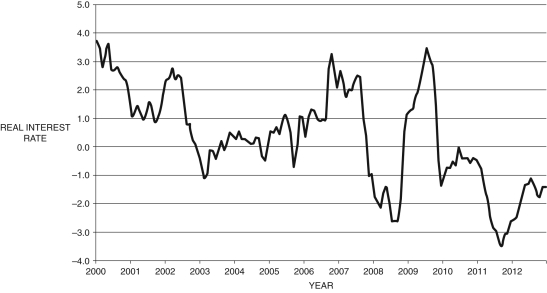

Below is the three-year bond real interest rate from 2000-2012. Explain why the real interest rate is positive for most of the 2000s and what explains it being negative in 2008-2009 and 2011-2012.

Figure 8.2: Three-Year Bond Real Interest Rate: 2000-2012

(Source: Federal Reserve Economic Data, St. Louis Federal Reserve)

Definitions:

Q22: When current output rises above potential output,

Q36: A key assumption of the short-run model

Q43: Briefly discuss the macroeconomic outcomes of the

Q59: Consider Table 7.1. In January 2012, the

Q60: From a low of _ percent in

Q77: Between May 2004 and May 2006, the

Q77: Unemployment due to institutional frictions is called

Q79: For any given saving rate, depreciation rate,

Q100: Consider the following Romer model of

Q105: Suppose you are given the data for