Refer to the following figure when answering

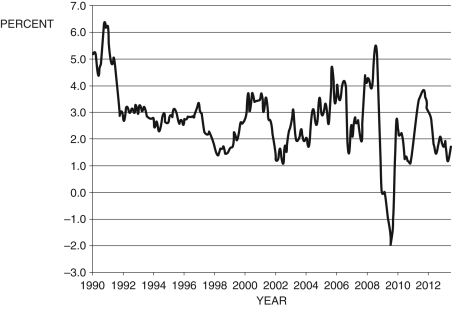

Figure 9.4: U.S. Inflation 1990-2012

(Source: Bureau of Labor Statistics)

-Consider two economies. Economy 1 has a steep Phillips curve and Economy 2 has a gently sloped Phillips curve. If each economy experiences an identical economic expansion, ________ would increase less in ________.

Definitions:

Discount Rate

The interest rate used in discounted cash flow (DCF) analysis to determine the present value of future cash flows, influencing investment decisions and valuation.

Compounded Interest

Interest calculated on the initial principal, which also includes all of the accumulated interest from previous periods on a deposit or loan.

Effective Annual Rate

The real interest rate on an investment or loan, taking into account the effect of compounding interest as opposed to just the nominal or stated rate.

Compounded Monthly

Interest on a loan or investment calculated monthly on both the initial principal and the accumulated interest from previous periods.

Q1: Consider Figure 11.2. How does the investment

Q24: The simple monetary policy rule discussed

Q40: Potential output is defined as:<br>A) the amount

Q41: Suppose <span class="ql-formula" data-value="\bar {

Q47: In the equation <span class="ql-formula"

Q55: In the quantity equation, the value

Q65: A change in which of the

Q71: Consider the IS curve in Figure 11.6.

Q81: Which of the following contributed to high

Q83: In 1979, in the face of rising