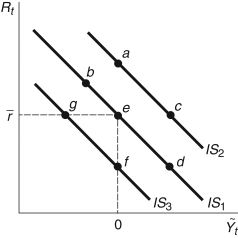

Refer to the following figure when answering

Figure 11.6: IS Curve

-Consider the IS curve in Figure 11.6. If the interest rate decreases and there is a negative aggregate demand shock, the economy will move to:

Definitions:

Spot Price

The current market price at which a particular asset, like a commodity, currency, or security, can be bought or sold for immediate delivery.

Futures Price

The agreed-upon price for a financial instrument or commodity to be sold or bought at a future date, used primarily in futures contracts trading.

Convergence Property

The characteristic of a mathematical series or economic model to approach a limit or a stable point over time.

Maturity

The date on which the principal amount of a bond, loan, or other financial instrument becomes due and is to be paid in full.

Q9: Which of the following features are frequently

Q11: In the real business cycle models, business

Q33: If some goods' prices adjust more quickly

Q71: With sticky prices, in the stylized DSGE

Q74: To identify an asset bubble, economists and

Q76: In 1933, the _ was established to

Q77: In the Smets-Wouters DSGE model, the

Q97: The coordination problem is difficult to solve

Q101: The IS curve describes the _ relationship

Q102: How does the simple monetary rule dictate