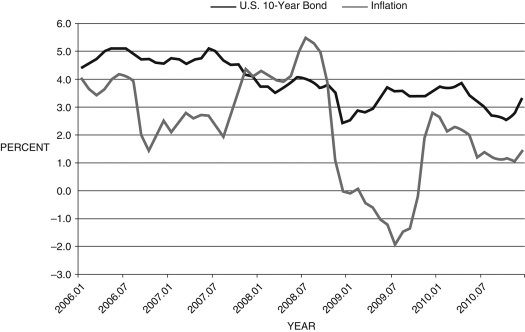

The following figure shows the inflation rate and ten-year bond yield. Refer to this figure when answering

Figure 14.4: Inflation and 10-Year Bond Yields

-Consider Figure 14.4 above. Between 2006 and 2007 the:

Definitions:

Put Option

A financial agreement granting the bearer the option, without being compelled, to offload a predetermined quantity of a fundamental asset at an agreed-upon price during a designated period.

Futures Contract

A contractual arrangement committing to the purchase or sale of a specific financial asset or commodity at an agreed price, set to occur at a future date.

Short-Sale

A trading strategy that involves selling borrowed securities with the expectation of buying them back at a lower price to profit from a decline in their value.

LIBOR

The London Interbank Offered Rate, previously a benchmark interest rate at which major global banks lend to one another.

Q3: When the Fed began to raise the

Q15: In the AS/AD framework, the financial friction

Q28: Consider Figure 11.2. How does the investment

Q55: The fundamental lesson of the life-cycle and

Q55: Consider Figure 12.2. If the Fed lowers

Q59: Figure 17.5 shows the quarterly investment-output ratio

Q78: An increase in the interest rate by

Q79: Which of the following countries does not

Q94: The system used for the social security

Q104: With sticky prices in the stylized DSGE