Antonio Hanley Owns a Small Automobile Service Center Additional Information Provided by Owner:

1

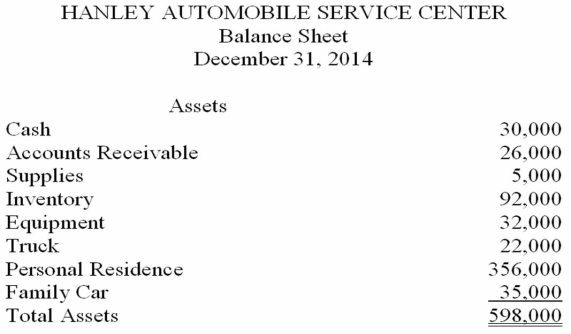

Antonio Hanley owns a small automobile service center. He recently approached the local bank for a loan to finance an expansion of his service center. Antonio prepared the balance sheet given below and submitted it with his loan application. The balance sheet does not conform to generally accepted accounting principles. Using the additional information provided by the owner, prepare a corrected balance sheet in accordance with generally accepted accounting principles.  Additional information provided by owner:

Additional information provided by owner:

1. The inventory has an original cost of . It is listed on the balance sheet at what it would cost to purchase today.

2. Included in the cash listed on the balance sheet is in Antonio Hanley's personal checking account.

3. Depreciation allowable to date on the equipment is . Depreciation allowable to date on the truck is .

Definitions:

Capital Balance

The amount of money invested in a business by its owners or shareholders, reflected in the company's balance sheet.

Revenue Accounts

These accounts track the income earned by a company from its sales or services before any deductions are made.

Expense Accounts

Accounts used to track money spent or costs incurred by a business in its operational activities.

Capital Accounts

Accounts that represent the ownership interest of investors in a company or partnership's total capital.

Q6: Uncollectible Accounts Expense can be called Loss

Q14: What is meant by the term blended

Q16: The International Court of Justice is also

Q23: On December 31, prior to adjustments, the

Q38: How do parliamentary systems generally differ from

Q38: The practice of estimating losses from uncollectible

Q42: To record the deposit of FUTA tax,

Q46: When the accrual basis of accounting is

Q63: A check issued for $890 to pay

Q73: The Boston Red Sox receives cash from