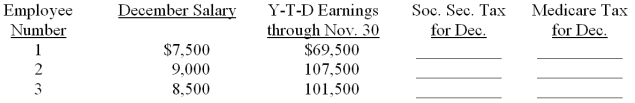

The monthly salaries for December and the year-to-date earnings as of November 30 for the three employees of the Lakeview Medical Center are listed below. Compute the amount of social security tax and Medicare tax to be withheld from each of the employee's gross pay for December. Assume a 6.2 percent social security tax rate and a base of $106,800 for the calendar year. Assume a 1.45 percent Medicare tax rate.

Definitions:

Uniquely Determined

A condition where a solution or outcome is specified exactly by the given constraints or equations without ambiguity.

Specified

Specified refers to being explicitly stated, defined, or detailed.

Sample Linear Regression Model

A statistical model that estimates the relationship between a dependent variable and one or more independent variables using a linear equation.

Slope Coefficient

In linear regression, a measure of the rate of change in the dependent variable for every one unit change in an independent variable.

Q7: Beachside Manufacturing estimates that its office employees

Q11: Which of the following describes Sales Tax

Q17: The entry to close the revenue account

Q29: To arrive at an accurate balance on

Q33: On a worksheet, the adjusted balance of

Q38: Wharfside Manufacturing estimates that its office employees

Q46: If the Income Summary account has a

Q57: Which of the following statements is not

Q59: The adjusted trial balance data given

Q72: The person or firm that issues a