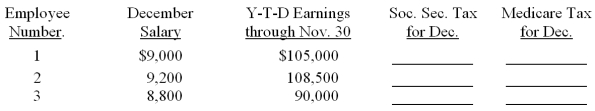

The monthly salaries for December and the year-to-date earnings as of November 30 for the three employees of Heather's Hair Salon are listed below. Compute the amount of social security tax and Medicare tax to be withheld from each of the employee's gross pay for December. Assume a 6.2 percent social security tax rate and a base of $106,800 for the calendar year. Assume a 1.45 percent Medicare tax rate.

Definitions:

Response

An answer or reaction provided as a reply to a question or action.

Level of Significance

The probability of rejecting the null hypothesis in a statistical test when it is actually true, used as a threshold for determining the statistical significance of results.

Political Party Affiliations

The alignment or association of an individual with a specific political party based on shared policies, beliefs, or ideologies.

Income Brackets

Categories of income levels used to classify or tax individuals differently based on their earnings.

Q3: Notations that allow transactions to be quickly

Q4: During one week, three employees of

Q40: On December 31, 2013, Designer's Warehouse received

Q43: Accrued income is income that has been<br>A)

Q57: When the allowance method of recognizing losses

Q67: The balances of the ledger accounts for

Q69: Complete the table below in accordance with

Q69: The number of the _ is recorded

Q77: A customer who returns goods or receives

Q81: The income statement shown below was prepared