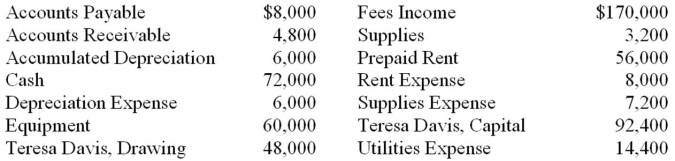

On December 31, the ledger of Davis Company contained the following account balances:  All the accounts have normal balances. Journalize the closing entries. Use 11 as the general journal page number.

All the accounts have normal balances. Journalize the closing entries. Use 11 as the general journal page number.

Definitions:

Shareholder

An individual or entity that owns shares in a corporation and therefore has ownership interest in the company.

Book Income

The income of a business reported in its financial statements, different from taxable income reported to the IRS.

Taxable Income

The amount of income used to determine how much tax an individual or a corporation owes to the government, after all deductions and exemptions have been accounted for.

Tax-Exempt

A status that exempts individuals or organizations from having to pay certain taxes.

Q1: The current worth of an asset is

Q20: The firm had net income if the

Q21: Opportunity costs are earnings or potential benefits

Q38: When an owner invests assets in a

Q41: The payroll register of the Fox Manufacturing

Q42: When the _ method of depreciation is

Q63: Which of the following is NOT an

Q65: Funds taken from the business by the

Q66: Sales Tax Payable is classified as a(n)

Q73: Each type of deduction made from the