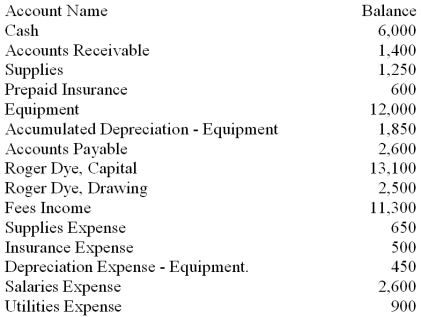

The adjusted ledger accounts of RD Consulting on December 31, 2013, appear as follows. All accounts have normal balances and adjusting entries have been made. Extend the balances to the Balance Sheet and Income Statement columns of the worksheet. Then, journalize the closing entries on page 4 of a general journal.

Definitions:

Federal Insurance Contributions Act

A U.S. law that requires employees to contribute to Social Security and Medicare, with matching contributions from employers.

Burden Of The Tax

The impact of a tax on the economic welfare of individuals, showing who ultimately bears the cost of the tax.

Excise Tax

A direct tax placed on manufactured goods, and is often levied at the time of manufacture, rather than at sale.

Inelastic Supply

A market condition where the quantity supplied of a good does not change significantly when its price changes.

Q4: The Purchases Returns and Allowances account is

Q5: Issued checks to pay salaries

Q13: Entries required to zero the balances of

Q15: If liabilities are $4,000 and owner's equity

Q26: The excess of net sales over the

Q34: If a decision must be made to

Q34: Form 940 must be filed _ time(s)

Q47: Which of the following statements is not

Q53: The discounts that are offered by suppliers

Q77: Another name for permanent accounts is real