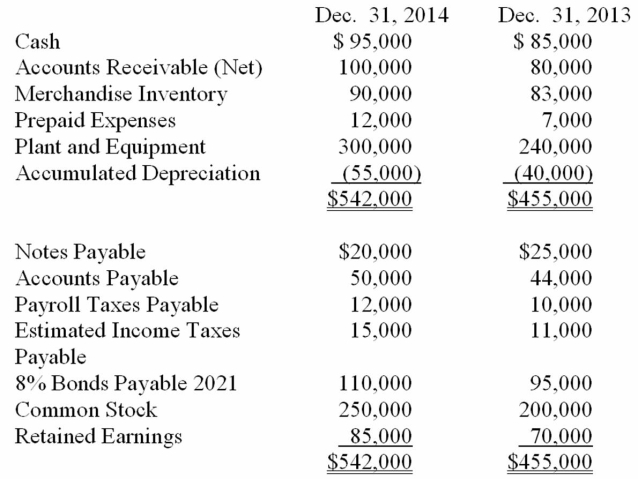

The following information is taken from the accounting records of the Gilford Corporation. Use this information to prepare Gilford's statement of cash flows for the year ended December 31, 2014.  Additional information:

Additional information:

(a) Plant construction costing $40,000 in cash was completed.

(b) Equipment was purchased for $20,000 in cash.

(c) Common stock was sold for $50,000 in cash.

(d) Bonds were issued for $15,000 in cash.

(e) Common stock dividends of $20,000 were paid in cash.

(f) Net income after income taxes was $35,000.

Definitions:

Direct Write-off

A method of accounting where uncollectible receivables are written off to expense only when they are deemed non-collectible.

Allowance Account

A contra account related to accounts receivable that estimates the amount of receivables which may not be collected.

Allowance for Doubtful Accounts

This accounting practice represents a reserve for accounts receivable that may not be collectible, reflecting potential future losses due to credit sales.

Debit Balance

A debit balance is the remaining amount of money in an account, typically a bank account or a business's financial account, after all debits have been accounted for.

Q34: Patents and copyrights are intangible assets.

Q50: Organization costs are carried indefinitely as an

Q50: The current ratio is a measure of

Q53: Use the high-low point method to determine

Q54: In a factory, the fixed costs per

Q55: Elsinore Corporation has outstanding 200,000 shares of

Q61: When the sum-of-the-years'-digits method is used to

Q63: Ari Hightower owns 200 shares of preferred

Q70: The Hoatzin Birdhouse Factory produced the

Q72: When the _ cost method is used