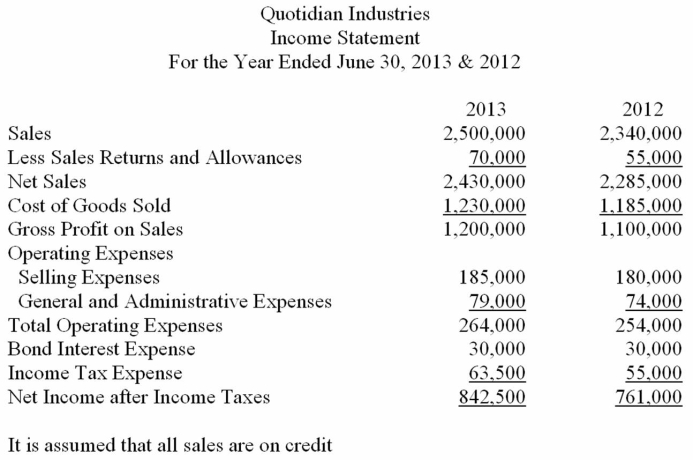

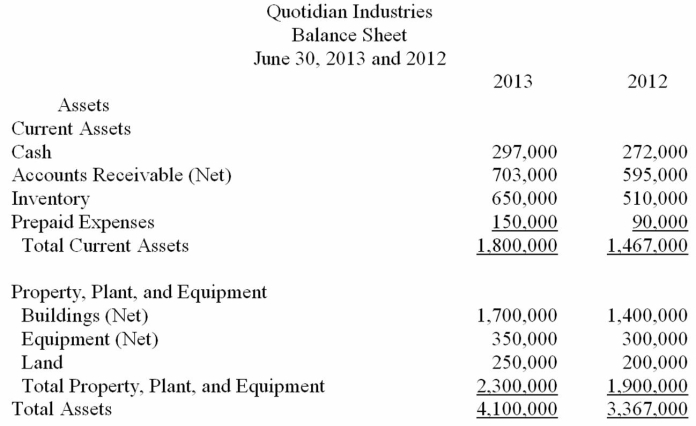

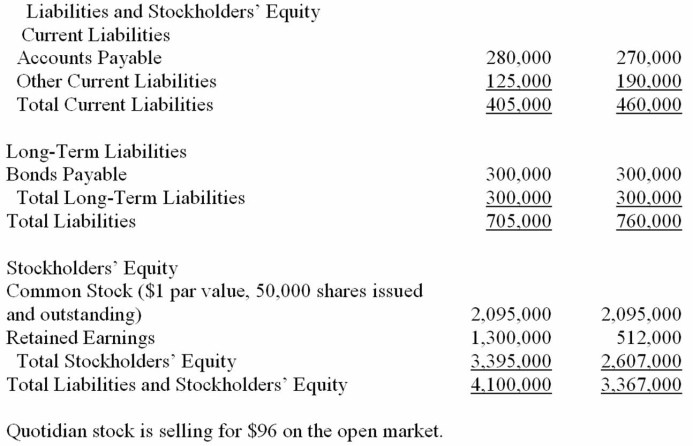

-Using the information given, analyze the profitability ratios of Quotidian Industries for 2013.

Definitions:

Tax Purposes

Refers to the specific motives or reasons related to computing taxable income, determining tax liabilities, and fulfilling tax reporting requirements under the law.

Personal/Rental Property

Refer to assets owned for personal use or rented out for income, impacting tax treatment and deductions.

Net Income

The total earnings of an individual or business after all taxes and other deductions have been subtracted.

Section 1202

A section of the Internal Revenue Code that provides a tax benefit for small business stockholders by excluding part of the gain realized on the sale or exchange of qualified small business stock held for more than five years.

Q11: Cody Reese, manager of Cobra Sports, Ink,

Q17: Under the perpetual inventory method, additions and

Q21: In each of the following situations, what

Q21: When a business is organized into separate

Q30: Departmental income statements provide management with information

Q34: To compute the cost of goods _,

Q42: Participating preferred stockholders<br>A) receive dividends only after

Q44: Subscriptions Receivable is the control account for

Q55: Using the information provided, prepare the cash

Q57: Under a job order cost system, unit