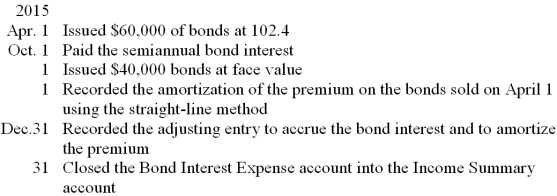

The board of directors of the Columbus Corporation authorized the issuance of $400,000 face value of 10-year, 12 percent bonds dated April 1, 2013, and maturing on April 1, 2023. Interest is payable semiannually on April 1 and October 1. Each bond has a face value of $1,000. Because the funds to be raised were not immediately needed, no bonds were issued until 2015. Record the following transactions on page 8 of a general journal. Omit descriptions.

Definitions:

Q2: Which of the following statements is not

Q33: If the income statement reflects a net

Q40: DJG Corporation purchased land in order to

Q42: The partnership _ is a written contract

Q49: Match the accounting terms with the description

Q66: How much interest will accrue on a

Q66: The Balance Sheet of a manufacturing firm

Q69: The entry to close the Manufacturing Summary

Q70: The payment of maturing bonds would be

Q77: After all revenue and expense accounts,