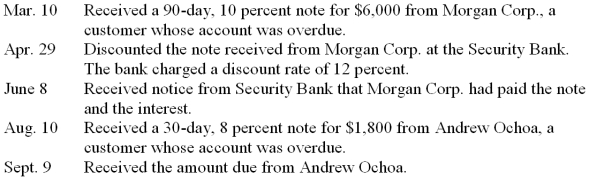

The Crown Company had the following transactions involving notes receivable during 2011. Record the transactions on page 7 of a general journal. Omit descriptions.

Definitions:

Interest Expense

Costs incurred by a borrower for the use of borrowed money, typically paid as a rate on loans or debt.

Borrowing Money

The act of obtaining funds from a lender under the agreement to repay them, usually with interest, over a specified period.

Other Expenses

Non-operating expenses that do not relate to the main operating activities of the business; they appear in a separate section on the income statement. One example given in the text is Interest Expense, interest owed on money borrowed by the company.

Income Statement

A financial statement that shows a company's revenues, expenses, and net income over a specific period.

Q1: Equipment that cost $20,000 was sold for

Q20: Receipts of interest revenue are classified as

Q21: On January 31, 2009, Village Bank had

Q23: The method of depreciation that results in

Q37: The June 1 inventory of the Kaufman

Q41: On, January 2, 2013, Rubble Sand and

Q60: Information from the Income Statement columns

Q67: A price reduction below the original markon

Q67: A firm purchased equipment for $6,000 on

Q170: Significance of cash flows<br>In the long run,