Financial ratios

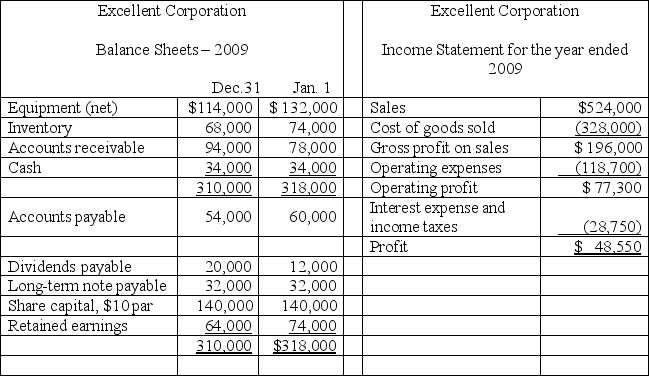

Given below are comparative balance sheets and an income statement for the Excellent Corporation:

All sales were made on account. Cash dividends declared during the year totaled $58,550. Compute the following:

All sales were made on account. Cash dividends declared during the year totaled $58,550. Compute the following:

Definitions:

Bitcoin

A digital currency that operates independently of a central bank or a single administrator, allowing users to send it directly to one another on the bitcoin network, which is peer-to-peer.

Traditional Currency

Money that is issued by governments as legal tender, typically in the form of coins and paper bills, used as a medium of exchange for goods and services.

Volatile

Pertains to substances that easily vaporize at normal temperatures or data storage that lose its content when power is switched off, in computing contexts.

B2B

Business-to-Business, transactions or commercial activities conducted between companies, as opposed to between companies and consumers (B2C).

Q18: Sam McGuire and Marcos Valle are partners,

Q27: Platinum Company reports profit of $520,000 for

Q29: Land purchased for a future building site

Q37: Use of the sum-of-the-years'-digits method of depreciation

Q39: If share is issued by a corporation

Q53: Treasury share is share that is issued

Q106: In the statement of cash flows, the

Q117: To qualify as a discontinued operation, a

Q130: The cost of the land sold during

Q132: Net cash from operating activities will have