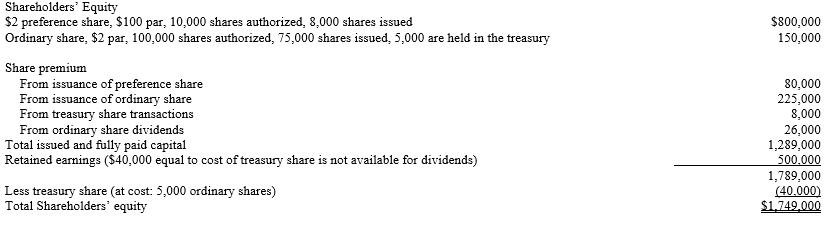

The shareholders' equity section of the balance sheet of Caesar Corporation at December 31, 2009, appears as follows: (The company engaged in no treasury share transactions prior to 2009)

-Refer to the data above. What was the original cost of the treasury share to Caesar Corporation?

Definitions:

Foreign Currency

Currency used in a country other than one's own, often requiring exchange for domestic currency in international trade or finance.

Foreign Exchange Gain

A profit arising from a change in exchange rates when foreign currency holdings are valued at a higher rate.

Foreign Exchange Gain

A profit resulting from the appreciation of one currency against another in the foreign exchange market.

U.S. Dollars

The currency of the United States, commonly used as a standard unit of currency in international markets.

Q8: The Music House issues a contract to

Q20: Diluted earnings per share are shown to

Q31: U. S. GAAP requires that convertible bonds

Q34: Differences between profit for the year and

Q60: Marks Corporation has total shareholders' equity of

Q62: Which of the following is considered a

Q65: Gains and losses from fluctuations in exchange

Q98: From the viewpoint of shareholders or potential

Q142: Which of the following is not true

Q204: After bonds have been issued, their market