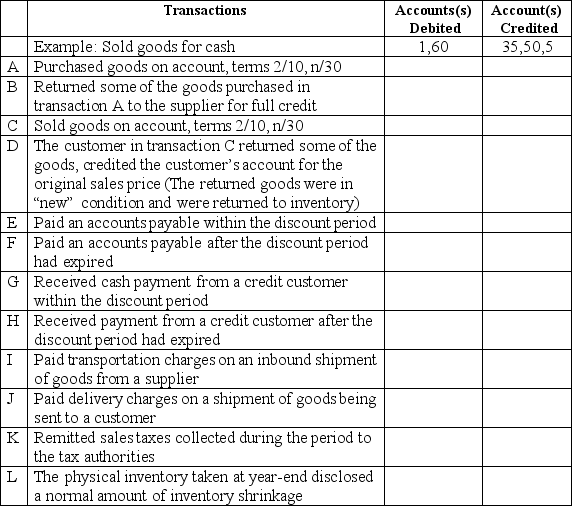

Journal entries for merchandising transactions

Shown below is a partial chart of accounts for Main Street Markets., followed by a series of merchandising transactions. The company uses a perpetual inventory system, records purchases at net cost, and records sales at the full invoice price. Sales taxes are collected on all sales, and the sales tax liability is recorded immediately. Freight charges on inbound shipments are recorded in the Transportation-in account. Indicate the accounts that should be credited in recording each transaction by placing the appropriate account number(s) in the space provided.

Definitions:

Annually Balancing

The process of adjusting or reconciling financial accounts or budgets to match or balance over a one-year period.

Cyclically Balanced Budget

A fiscal strategy where the government aims to balance its budget over the complete economic cycle, accumulating surpluses in boom periods and deficits during recessions.

Budget Deficits

A financial situation where a government's expenditures surpass its revenues.

Budget Surpluses

A situation where a government's revenue exceeds its expenditures over a specific period, indicating financial health.

Q18: Harris Corporation's inventory of a particular product

Q27: Refer to the above data. At the

Q57: If an asset was purchased on January

Q89: Which of the following accounting principles is

Q89: Jayson Products uses a perpetual inventory system.

Q96: Accounts receivable turnover rate<br>During 2010, Larsen Company's

Q118: In a period of rising prices, a

Q119: What was the gross profit for the

Q123: Computation of Goodwill<br>The profit of Greystone, Inc.,

Q178: Bank reconciliation--classification<br>Indicate how the following items would