Adjustments and closing process--basic entries

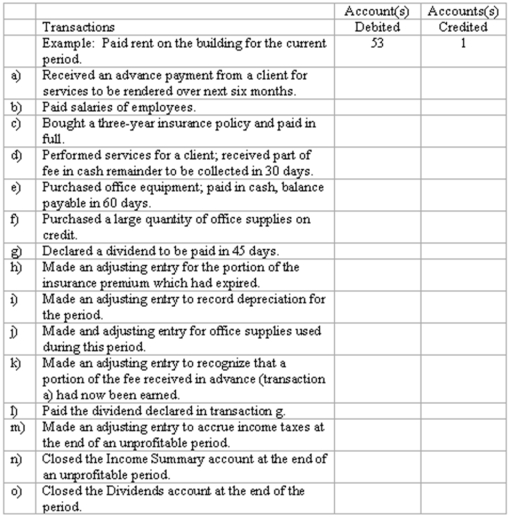

Selected ledger accounts used by Goldstone Advertising Limited, are listed along with identifying numbers. Following this list of account numbers and titles is a series of transactions. For each transaction, you are to indicate the proper accounts to be debited and credited.

Definitions:

Net Operating Income

The profit a company generates from its regular business operations, excluding expenses and revenues from non-operating activities.

Client-visits

The act of meeting with clients or potential clients, often for the purposes of discussing business opportunities, providing services, or strengthening relationships.

Activity Variance

The difference between the budgeted and actual amount of an activity, such as hours worked or units produced, affecting budget and cost planning.

Budgeting

A financial planning process that involves the estimation of future revenues and expenses over a specified period.

Q22: Periodic inventory system<br>Armstrong Creation uses a

Q30: Refer to the above data. In a

Q39: The general purpose financial statements prepared annually

Q40: Adjustments and closing process--basic entries<br>Selected ledger

Q64: The Retained Earnings statement is based upon

Q89: If an error in valuing inventory occurs

Q94: Refer to the above data. If Share

Q115: Under the allowance method, when a receivable

Q124: An NSF check returned by the bank

Q133: Information for the Hooper Company is