Adjustments and closing process-basic entries

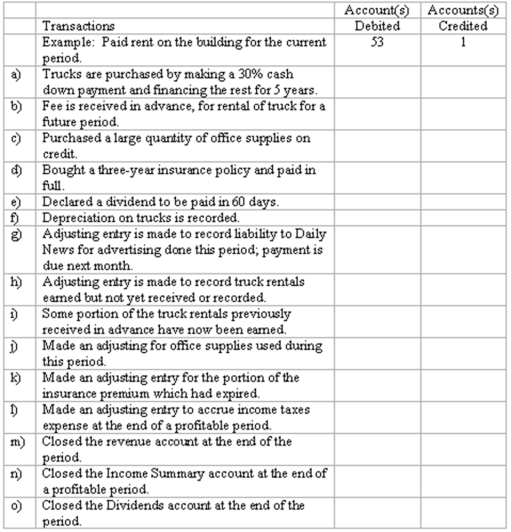

Selected ledger accounts used by Speedy Truck Rentals Limited, are listed along with identifying numbers. Following this list of account numbers and titles is a series of transactions. For each transaction, you are to indicate the proper accounts to be debited and credited.

Definitions:

Growth

Refers to the increase in size, value, or importance of an entity over time.

Sales

The trade of goods or services for financial compensation, which serves as the fundamental revenue generator for the majority of corporations.

Finished Goods Inventory

The stock of completed products ready for sale, representing one of the final stages in the production process.

Sales Forecast

An estimate of future sales, often based on historical data, current market trends, and forward-looking economic indicators, used for planning and decision-making purposes.

Q5: Assume that the net realizable value of

Q20: Closing entries<br>An Adjusted Trial Balance for

Q21: The Code of Ethics of the AICPA

Q36: Refer to the above data. The journal

Q48: Which of the following is not considered

Q53: An inexperienced accounting intern at Tasso

Q81: Bruno's Pizza Restaurant makes full payment of

Q109: If current assets are $110,000 and current

Q148: Refer to the above data. Assuming Neptune

Q176: After preparing a bank reconciliation, a journal