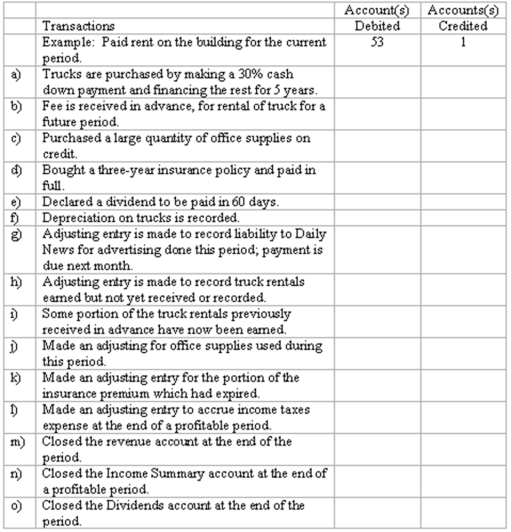

Adjustments and closing process-basic entries

Selected ledger accounts used by Speedy Truck Rentals Limited, are listed along with identifying numbers. Following this list of account numbers and titles is a series of transactions. For each transaction, you are to indicate the proper accounts to be debited and credited.

Definitions:

MRP

Marginal revenue product, the additional revenue generated by employing one more unit of a resource.

Wage Rate

The standard amount of pay given to employees per unit of time, which may vary based on industry, occupation, and experience.

Competitive Labor Market

A market where workers compete for jobs and employers compete for workers, influencing wages and employment conditions.

Marginal Revenue Product

The increase in revenue generated by employing one more unit of a resource.

Q3: If sales discounts are shown as a

Q6: Refer to the above data. What amount

Q23: During the current year, the assets of

Q35: What were the goods available for sale

Q40: The cost of insurance is considered an

Q68: A line of credit creates a liability

Q74: Compute the cost of the ending inventory

Q96: It is the function of management accounting

Q112: Instead of paying for goods purchased on

Q156: In a periodic inventory system, the cost