Recording transactions in T accounts; trial balance

On May 15, George Manny began a new business, called Sounds Limited, a recording studio to be rented out to artists on an hourly or daily basis. The following six transactions were completed by the business during May:

(A.) Issued to Manny 5,000 shares of share capital in exchange for his investment of $200,000 cash.

(B.) Purchased land and a building for $410,000, paying $100,000 cash and signing a note payable for the balance. The land was considered to be worth $310,000 and the building $100,000.

(C.) Installed special insulation and soundproofing throughout most of the building at a cost of $120,000. Paid $32,000 cash and agreed to pay the balance in 60 days. Manny considers these items to be additional costs of the building.

(D.) Purchased office furnishings costing $18,000 and recording equipment costing $88,400 from Music Supplies. Sounds paid $28,000 cash with the balance due in 30 days.

(E.) Borrowed $180,000 from a bank by signing a note payable.

(F.) Paid the full amount of the liability to Music Supplies arising from the purchases in D above.

Instructions

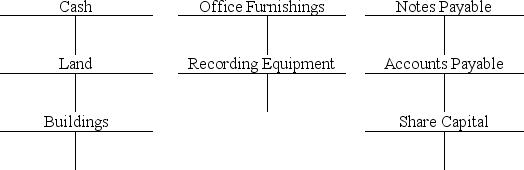

(A.) Record the above transactions directly in the T accounts below. Identify each entry in a T account with the letter shown for the transaction. This exercise does not call for the use of a journal.

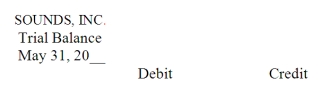

(B.) Prepare a trial balance at May 31 by completing the form provided.

(B.) Prepare a trial balance at May 31 by completing the form provided.

Definitions:

MMPI

The Minnesota Multiphasic Personality Inventory, a standardized psychometric test of adult personality and psychopathology used to diagnose mental disorders.

Reliability And Validity

The consistency and accuracy of a measurement or assessment tool.

Diagnose

The process of identifying a disease or condition from its symptoms and signs through examination and tests.

Mental Disorders

Health conditions characterized by alterations in thinking, mood, or behavior associated with distress and/or impaired functioning.

Q22: The term <i>revenue</i> can best be described

Q23: Matching principle<br>In April, Grinnel Paving Limited acquired

Q34: If Income Summary has a net credit

Q72: Publicly traded companies must file audited financial

Q94: The cost of the transportation of inventory

Q96: A journal entry to recognize an expense

Q114: Transactions are recorded in the general journal

Q114: At the end of the current year,

Q121: Which of the following is<i> not</i> an

Q122: TPX Company's 2013 debt to equity ratio