Recording transactions in T accounts; trial balance

On May 15, George Manny began a new business, called Sounds Limited, a recording studio to be rented out to artists on an hourly or daily basis. The following six transactions were completed by the business during May:

(A.) Issued to Manny 5,000 shares of share capital in exchange for his investment of $200,000 cash.

(B.) Purchased land and a building for $410,000, paying $100,000 cash and signing a note payable for the balance. The land was considered to be worth $310,000 and the building $100,000.

(C.) Installed special insulation and soundproofing throughout most of the building at a cost of $120,000. Paid $32,000 cash and agreed to pay the balance in 60 days. Manny considers these items to be additional costs of the building.

(D.) Purchased office furnishings costing $18,000 and recording equipment costing $88,400 from Music Supplies. Sounds paid $28,000 cash with the balance due in 30 days.

(E.) Borrowed $180,000 from a bank by signing a note payable.

(F.) Paid the full amount of the liability to Music Supplies arising from the purchases in D above.

Instructions

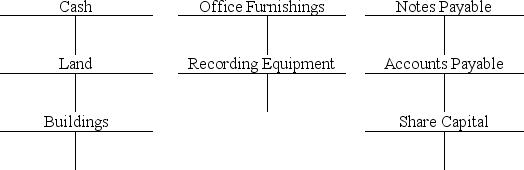

(A.) Record the above transactions directly in the T accounts below. Identify each entry in a T account with the letter shown for the transaction. This exercise does not call for the use of a journal.

(B.) Prepare a trial balance at May 31 by completing the form provided.

(B.) Prepare a trial balance at May 31 by completing the form provided.

Definitions:

Trapezoidal

A shape or form characterized by a four-sided polygon with at least one pair of parallel sides.

Cross Section

A view or drawing that shows what the inside of something looks like after a cut has been made perpendicular to its axis.

Radial-Contact Bearings

Bearings that support loads perpendicular to the axis of the shaft.

Thrust Loads

Forces applied along the axis of a shaft or bearing that push against the bearing's face, often caused by helical gears or inclines.

Q3: We can use ratios to help evaluate

Q12: BC Training reports sales revenue of $2,200,000.

Q16: If a company purchases equipment by issuing

Q18: Prepaid expenses are:<br>A) Assets.<br>B) Income.<br>C) Liabilities.<br>D) Expenses.

Q26: What is the annual market interest rate

Q31: In a periodic inventory system, the Inventory

Q37: The Cost of Goods Sold account is

Q44: Failure to make the appropriate adjustment to

Q104: Increases in equity are recorded by credits;

Q130: Refer to the above data. On January