Completion of balance sheet

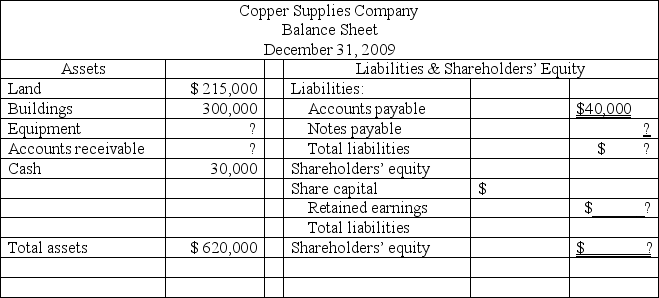

Use the following information to complete the December 31, 2009, balance sheet of Copper Supplies Company.

(1) Equity as of January 1, 2009, totaled $175,000, which included share capital of $150,000.

(2) Additional capital stock was issued during 2009 in exchange for $40,000 cash.

(3) Profit for 2009 amounted to $200,000; no dividends were paid during 2009.

(4) Cash and accounts receivable together amount to 3 times as much as accounts payable.

Definitions:

Tax Liability

The total amount of tax owed to a taxing authority based on the taxable income of an individual or corporation.

Taxable Income

The amount of income used to calculate an individual's or a company's income tax due, determined by subtracting deductions and exemptions from total income.

Tax Liability

The total amount of taxes owed by an individual, corporation, or other entity to taxing authorities, such as the federal or state government, based on income, property value, or other taxable assets.

Tax Withheld

Funds that an employer deducts from an employee's wages for tax purposes, to be paid directly to the government.

Q6: Financial statements are prepared:<br>A) Only for publicly

Q10: A balance sheet is designed to show:<br>A)

Q27: Assuming a current ratio of 1.0, how

Q29: Under the Sarbanes-Oxley Act, CFOs and high-ranking

Q36: The concept of materiality:<br>A) Involves only tangible

Q42: The adjusted trial balance may be used

Q82: At the end of last year, Baron's

Q90: The balance in the Inventory account at

Q90: Return on equity is calculated by dividing

Q101: In the notes to financial statements, adequate