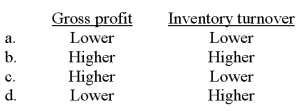

Company A is identical to Company B in every regard except that Company A uses FIFO and Company B uses LIFO. In an extended period of rising inventory costs, Company A's gross profit and inventory turnover, compared to Company B's, would be:

Definitions:

Activity-Based Costing

A pricing strategy that attributes overhead and indirect expenses to associated goods and services by determining cost drivers.

Traditional Costing Method

An accounting approach that assigns manufacturing overhead costs to products based on volume-related measures such as direct labor hours or machine hours.

Activity-Based Costing

An accounting methodology that assigns costs to products or services based on the activities that go into producing them, aiming for more accurate allocation of overhead costs.

Traditional Costing Method

A method of accounting that assigns costs to products based on an average overhead rate. It tends to allocate indirect costs based on a single, volume-based cost driver.

Q3: Investing cash flows would include which of

Q11: In each succeeding payment on an installment

Q89: Cash transactions that have been recorded by

Q99: Which accounting principle does the direct write-off

Q122: Inventory records for Marvin Company revealed

Q131: Inventory records for Marvin Company revealed

Q140: Assuming a current ratio of 1.0 and

Q145: The use of the lower-of-cost-or-market method to

Q150: LeGrand Corporation reported the following amounts

Q181: The primary difference between a note receivable