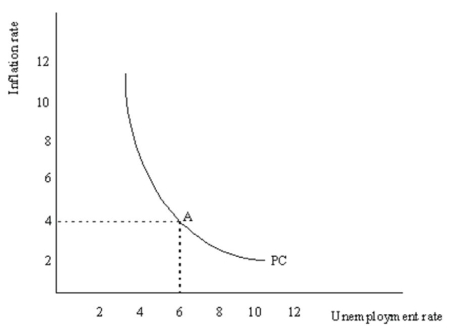

Consider the following Phillips curve diagram:

(a)The economy is currently at point A with unemployment of 6% and inflation of 4%.The President has informed you that she is about to undertake an expansionary fiscal policy designed to lower unemployment from its current rate of 6% to 4%.She asks you what will happen in the economy as a result of her policy.Base your answer on the Phillips curve in the above diagram.

(a)The economy is currently at point A with unemployment of 6% and inflation of 4%.The President has informed you that she is about to undertake an expansionary fiscal policy designed to lower unemployment from its current rate of 6% to 4%.She asks you what will happen in the economy as a result of her policy.Base your answer on the Phillips curve in the above diagram.

(b)How would your answer to (a)above change if you were to take into account potential changes in inflation expectations and their impact on actual inflation?

Definitions:

Taxable Income

The portion of income subject to taxation by governmental authorities after accounting for deductions and exemptions.

Working Capital

Working capital refers to the difference between a company's current assets and current liabilities, indicating the liquidity and short-term financial health of the business.

Taxable Income

The portion of an individual's or corporation's income used to determine how much tax is owed to the government.

Internal Rate

An implied interest rate that equates the present value of an investment's expected future cash inflows to its initial cost.

Q2: (a)Demonstrate graphically and explain the implications of

Q3: Which of the following valuation methods is

Q11: Suppose you were placed in charge of

Q25: Briefly describe three different ways that people

Q26: If asset inflation has occurred,which has changed:

Q27: What are extrapolative expectations,and why are they

Q31: Consider the following information about production

Q41: Which of the following characteristics does not

Q51: Risk in investment can be eliminated by

Q61: A problem with the increased importance of