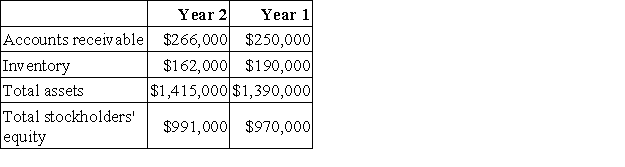

Burdick Corporation has provided the following financial data from its balance sheet:  Sales (all on account) in Year 2 amounted to $1,410,000 and the cost of goods sold was $860,000. The company's total asset turnover for Year 2 is closest to:

Sales (all on account) in Year 2 amounted to $1,410,000 and the cost of goods sold was $860,000. The company's total asset turnover for Year 2 is closest to:

Definitions:

Accrual-based Income

A method of accounting that records revenue when it is earned and expenses when they are incurred, regardless of when cash is received or paid.

Tax Rate

The percentage at which an individual or corporation is taxed by the government.

Deferred Income Taxes

Taxes applicable to income that are due in the future periods due to temporary differences between the tax base of assets or liabilities and their carrying amount in the financial statements.

Operating Income

The profit realized from a business's core operating activities, excluding non-operating income, taxes, and interest expenses.

Q2: Muzyka Corporation uses the FIFO method in

Q14: Assume an economy produces just cars

Q15: In 2006,Bob's Burgers charged $3.50 for a

Q37: What is the formal definition of the

Q38: A given basket of goods cost $600

Q50: The North Division of the Lyman Company

Q64: Nouri Corporation uses the FIFO method in

Q65: Which of the following would be an

Q67: The Consumer Products Division of Mickolick Corporation

Q91: ROI and residual income are tools used