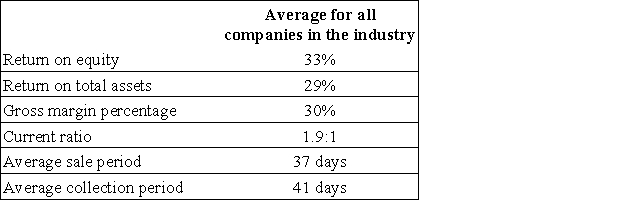

M. K. Berry is the managing director of CE Ltd. a small, family-owned company which manufactures cutlery. His company belongs to a trade association which publishes a monthly magazine. The latest issue of the magazine contains a very brief article based on the analysis of the accounting statements published by the 40 companies which manufacture this type of product. The article contains the following table:  CE Ltd's latest financial statements are as follows:

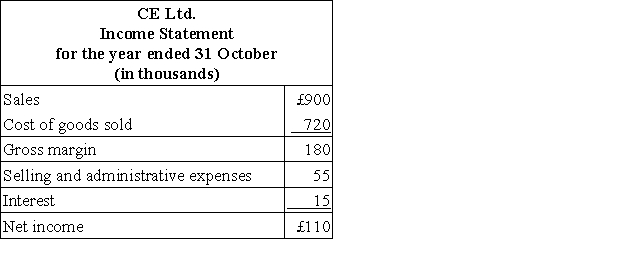

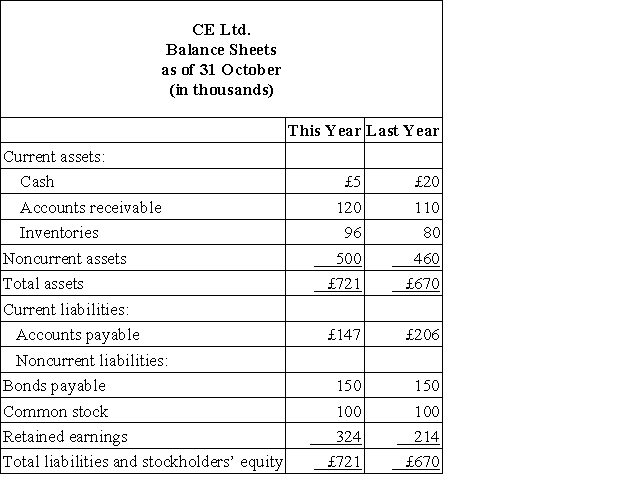

CE Ltd's latest financial statements are as follows:  The country in which the company operates has no corporate income tax. No dividends were paid during the year. All sales are on account.

The country in which the company operates has no corporate income tax. No dividends were paid during the year. All sales are on account.  Required:

Required:

a. Calculate each of the ratios listed in the magazine article for this year for CE, and comment briefly on CE Ltd's performance in comparison to the industrial averages.

b. Explain why it could be misleading to compare CE Ltd's ratios with those taken from the article.

Definitions:

Allowance Method

An accounting technique that estimates and records bad debts expense from credit sales.

Bad Debt Expense

An expense account representing accounts receivable that a company does not expect to collect and writes off as a loss.

Allowance for Doubtful Accounts

A contra account that reduces the total receivables on the balance sheet to reflect the amount that is expected not to be collected.

Selling Receivables

The process of selling a company's outstanding invoices to a third party to improve cash flow and reduce risk.

Q8: Net operating income is defined as:<br>A)net income

Q39: Vinup Corporation has provided the following data

Q59: The Jenkins Division recorded operating data as

Q73: Consider the following three conditions: I. An

Q96: Ribaudo Corporation has provided the following financial

Q97: Last year the Uptown Division of Gorcen

Q111: Aguilera Industries is a division of a

Q113: The formula for the times interest earned

Q152: If current assets exceed current liabilities, prepaying

Q183: Data from Dunshee Corporation's most recent balance