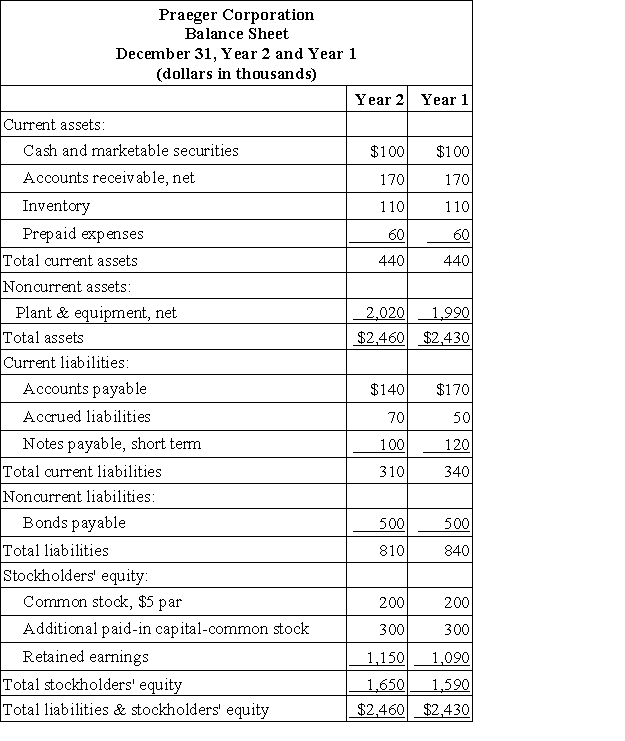

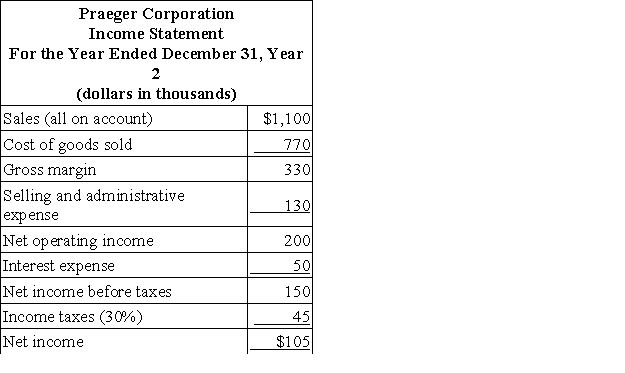

Financial statements for Praeger Corporation appear below:

Dividends during Year 2 totaled $45 thousand. The market price of a share of common stock on December 31, Year 2 was $30.

Dividends during Year 2 totaled $45 thousand. The market price of a share of common stock on December 31, Year 2 was $30.

Required:

Compute the following for Year 2:

a. Return on total assets.

b. Working capital.

c. Current ratio.

d. Acid-test ratio.

e. Accounts receivable turnover.

f. Average collection period.

g. Inventory turnover.

h. Average sale period.

i. Times interest earned.

j. Debt-to-equity ratio.

Definitions:

Enter Bills

The process of recording invoices from suppliers or creditors in the accounting system, often as a precursor to issuing payments.

Receive Payments

The process of collecting money from customers or clients against invoices or bills, marking them as paid.

Pay Bills

The action of settling obligations or invoices owed to suppliers by a business, often through a specific module or function within accounting software.

Financial Institutions

Organizations that provide financial services, such as banks, credit unions, and insurance companies.

Q6: Explain what it means to say that

Q7: What is the argument for laissez faire

Q14: Many state governments support higher education through

Q38: The West Division of Frede Corporation had

Q86: Neef Corporation has provided the following financial

Q103: Net operating income is income after interest

Q114: Chabot Company had the following results last

Q128: Sholette Manufacturing Corporation has a standard cost

Q242: A company whose inventory turnover ratio is

Q340: A quantity standard indicates how much output