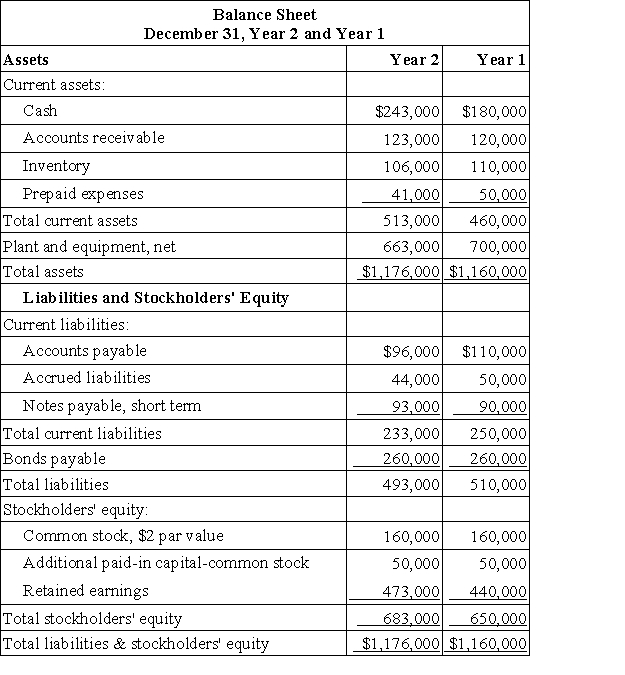

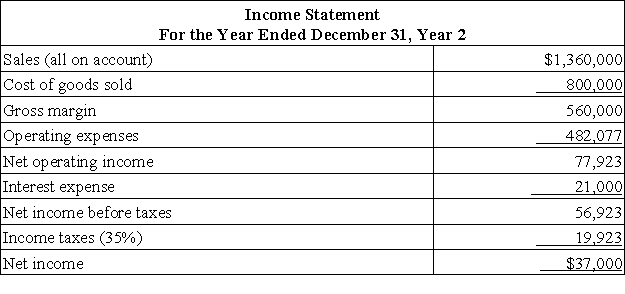

Kisselburg Corporation has provided the following financial data:

Dividends on common stock during Year 2 totaled $4,000. The market price of common stock at the end of Year 2 was $5.75 per share.

Dividends on common stock during Year 2 totaled $4,000. The market price of common stock at the end of Year 2 was $5.75 per share.

Required:

a. What is the company's working capital at the end of Year 2?

b. What is the company's current ratio at the end of Year 2?

c. What is the company's acid-test (quick) ratio at the end of Year 2?

d. What is the company's accounts receivable turnover for Year 2?

e. What is the company's average collection period (age of receivables) for Year 2?

f. What is the company's inventory turnover for Year 2?

g. What is the company's average sale period (turnover in days) for Year 2?

h. What is the company's operating cycle for Year 2?

i. What is the company's total asset turnover for Year 2?

j. What is the company's times interest earned for Year 2?

k. What is the company's debt-to-equity ratio at the end of Year 2?

l. What is the company's equity multiplier at the end of Year 2?

m. What is the company's net profit margin percentage for Year 2?

n. What is the company's gross margin percentage for Year 2?

o. What is the company's return on total assets for Year 2?

p. What is the company's return on equity for Year 2?

q. What is the company's earnings per share for Year 2?

r. What is the company's price-earnings ratio for Year 2?

s. What is the company's dividend payout ratio for Year 2?

t. What is the company's dividend yield ratio for Year 2?

u. What is the company's book value per share at the end of Year 2?

Definitions:

Neurons Sensitivity

The capacity of neurons to respond to stimuli or changes in the environment, affecting how signals are transmitted through the nervous system.

Receptor Molecules

Molecules, usually found on cell surfaces, that recognize and bind to specific substances, triggering a response.

Neurotransmitter

A chemical substance that is released at the end of a nerve fiber by the arrival of a nerve impulse and, by diffusing across the synapse, causes the transfer of the impulse to another nerve fiber, a muscle fiber, or some other structure.

Ligand-Gated Channels

Ion channels in cell membranes that open or close in response to the binding of a chemical signal (ligand), allowing ions to pass through the membrane.

Q5: Jolin Corporation keeps careful track of the

Q8: The diagram below represents the consumer side

Q14: Dratif Corporation's working capital is $33,000 and

Q25: How does socialism as it was practiced

Q27: Which economic system depends primarily on tradition

Q30: Baldock Inc. is considering the acquisition of

Q38: Consider the following statement: Keith purchased an

Q85: Chee Corporation has gathered the following data

Q86: Randal Corporation recorded the following activity for

Q100: Kestner Corporation has provided the following financial