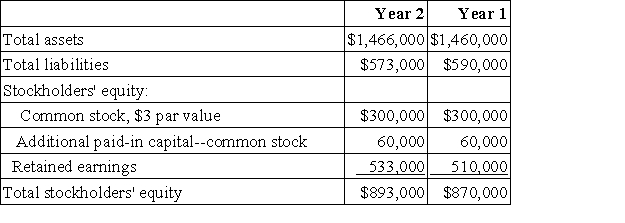

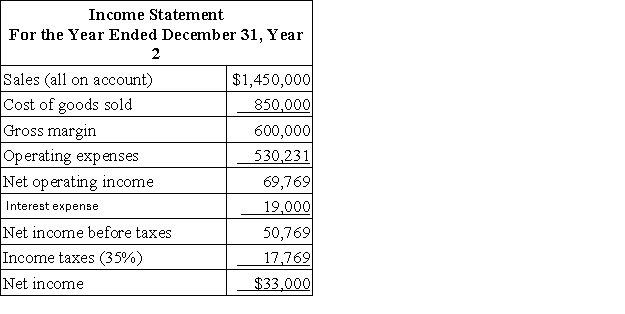

Jaquez Corporation has provided the following financial data:

Dividends on common stock during Year 2 totaled $10,000. The market price of common stock at the end of Year 2 was $5.45 per share.

Dividends on common stock during Year 2 totaled $10,000. The market price of common stock at the end of Year 2 was $5.45 per share.

Required:

a. What is the company's times interest earned for Year 2?

b. What is the company's debt-to-equity ratio at the end of Year 2?

c. What is the company's equity multiplier at the end of Year 2?

d. What is the company's net profit margin percentage for Year 2?

e. What is the company's gross margin percentage for Year 2?

f. What is the company's return on total assets for Year 2?

g. What is the company's return on equity for Year 2?

h. What is the company's earnings per share for Year 2?

i. What is the company's price-earnings ratio for Year 2?

j. What is the company's dividend payout ratio for Year 2?

k. What is the company's dividend yield ratio for Year 2?

l. What is the company's book value per share at the end of Year 2?

Definitions:

Advance Notice

Advance notice refers to informing parties involved about actions, decisions, or events before they happen, allowing time for preparation or adjustment.

One-minute Praising

A brief, immediate positive feedback technique focusing on acknowledging and reinforcing good work or behavior quickly.

Psychological Investment

Psychological investment is the emotional or cognitive energy that an individual allocates to a job, project, or relationship.

Specific

Clearly defined or identified; precise and not vague, ensuring that there is no ambiguity.

Q6: The three primary forms of business are

Q21: In October, one of the processing departments

Q70: Dukas Corporation's net cash provided by operating

Q74: Dul Corporation has provided the following data

Q87: Deflorio Corporation's inventory at the end of

Q234: Financial statements for Rardin Corporation appear below:

Q255: Hatzenbuhler Manufacturing Corporation has prepared the following

Q278: Lasch Corporation has provided the following financial

Q294: Waste on the production line will result

Q411: The following labor standards have been established