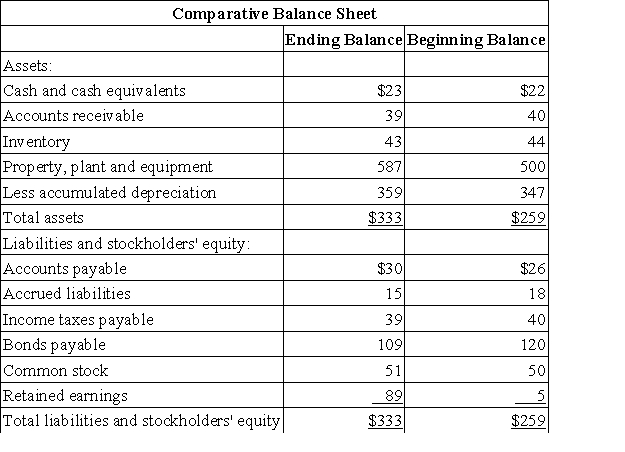

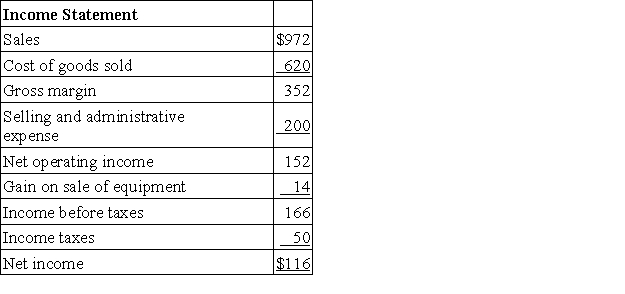

Mattix Corporation's balance sheet and income statement appear below:

The company sold equipment for $20 that was originally purchased for $7 and that had accumulated depreciation of $1. It paid a cash dividend during the year and did not issue any bonds payable or repurchase any of its own common stock.

The company sold equipment for $20 that was originally purchased for $7 and that had accumulated depreciation of $1. It paid a cash dividend during the year and did not issue any bonds payable or repurchase any of its own common stock.

Required:

Determine the net cash provided by (used in) operating activities for the year using the indirect method.

Definitions:

Mutual Adjustment

A process of coordination between parties or groups that is based on informal communication and spontaneous problem-solving.

Divisions of Labour

The allocation or distribution of tasks among workers, systems, or organizations, specialized to increase efficiency and productivity.

Routine Tasks

Tasks that are performed in a predictable and standardized manner, often with repetition.

Complicated Tasks

Tasks that involve multiple steps, variables, or components, requiring significant mental effort and skill to solve.

Q31: Reid Corporation uses a process costing system

Q41: Financial statements for Maraby Corporation appear below:

Q44: The Fischer Corporation uses a standard costing

Q74: An increase in accrued liabilities of $1,000

Q99: A profit center is responsible for generating

Q101: The most recent comparative balance sheet of

Q157: As the accounts receivable turnover ratio decreases,

Q194: Financial statements for Maraby Corporation appear below:

Q261: Bard Hotel bases its budgets on guest-days.

Q262: Mayfield Corporation has provided the following financial