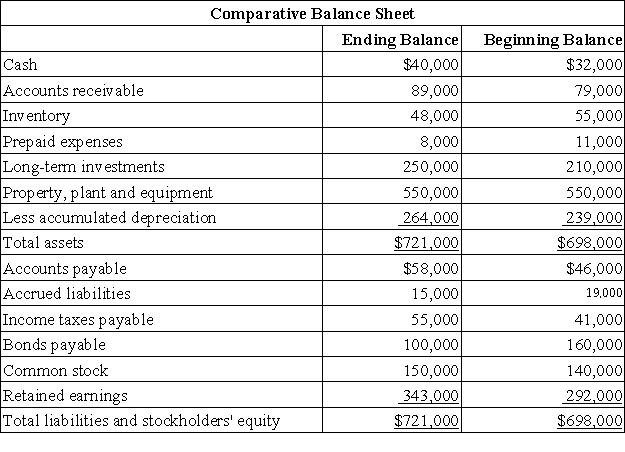

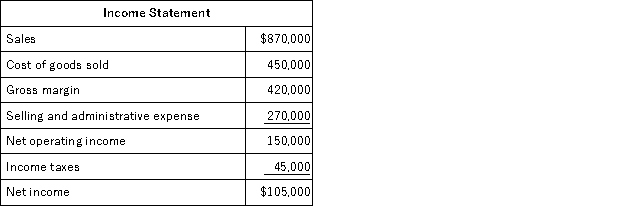

Walmouth Corporation's comparative balance sheet and income statement for last year appear below:

The company declared and paid a cash dividend of $54,000 during the year. It did not purchase or dispose of any property, plant, and equipment. It did not issue any bonds or repurchase any of its own common stock. The following questions pertain to the company's statement of cash flows. The net cash provided by (used in) operating activities last year was:

The company declared and paid a cash dividend of $54,000 during the year. It did not purchase or dispose of any property, plant, and equipment. It did not issue any bonds or repurchase any of its own common stock. The following questions pertain to the company's statement of cash flows. The net cash provided by (used in) operating activities last year was:

Definitions:

Partnership

A business structure in which two or more individuals manage and operate a business in accordance with the terms and objectives set out in a partnership agreement.

Sole Proprietorship

A business in which one person (sole proprietor) controls the management and profits.

Entity Partnership

A business structure where two or more entities join together in partnership to conduct business.

Limited Liability Company

A corporate framework that merges the tax benefits of a sole proprietorship or partnership with the protective limited liability found in a corporation.

Q3: Alcoser Corporation's most recent balance sheet appears

Q11: In September, the Universal Solutions Division of

Q35: Suppose Mr.and Mrs.X have an ant problem

Q38: The Warrel Corporation reported the following data

Q57: Financial statements for Maraby Corporation appear below:

Q72: Which one of the following transactions should

Q72: Kearin Corporation has provided the following financial

Q115: The gross margin percentage is computed by

Q272: Machain Corporation applies manufacturing overhead to products

Q306: Privett Hospital bases its budgets on patient-visits.