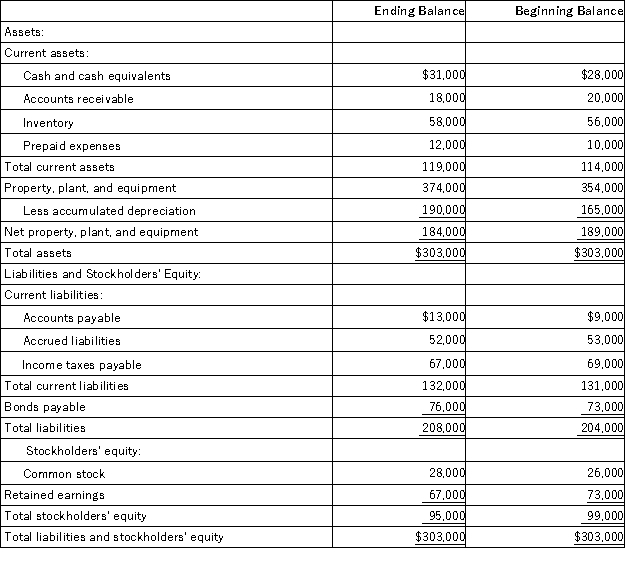

Krech Corporation's comparative balance sheet appears below:  The company's net income (loss) for the year was ($3,000) and its cash dividends were $3,000. It did not sell or retire any property, plant, and equipment during the year. The company uses the indirect method to determine the net cash provided by operating activities. The company's net cash provided by operating activities is:

The company's net income (loss) for the year was ($3,000) and its cash dividends were $3,000. It did not sell or retire any property, plant, and equipment during the year. The company uses the indirect method to determine the net cash provided by operating activities. The company's net cash provided by operating activities is:

Definitions:

Income Tax Rate

The Income Tax Rate is the percentage at which an individual or corporation is taxed on their income, varying according to earnings and jurisdictional tax laws.

After-Tax Discount Rate

The rate of return used in capital budgeting that accounts for taxes, providing a more accurate measure of net present value or investment profitability.

Straight-Line Depreciation

A procedure for apportioning the cost of a tangible good over its operational lifespan in uniform annual amounts.

Initial Investments

The initial capital outlay required to start a project, purchase assets, or acquire a company, reflecting the upfront costs to begin operations.

Q5: Carriveau Corporation's most recent balance sheet appears

Q7: Hairston Corporation manufactures and sells a single

Q37: Krech Corporation's comparative balance sheet appears below:

Q43: In December, one of the processing departments

Q63: Dahn Corporation has provided the following financial

Q77: Harris Corporation, a retailer, had cost of

Q86: Ok Corporation keeps careful track of the

Q131: Symons Corporation has provided the following financial

Q232: Neelty Corporation has interest expense of $16,000,

Q251: Data from Lheureux Corporation's most recent balance