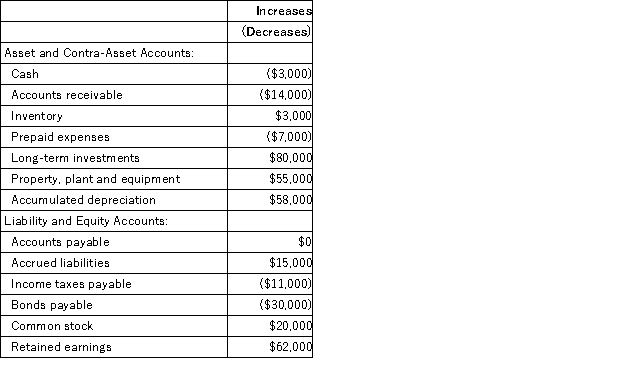

Megan Corporation's net income last year was $98,000. Changes in the company's balance sheet accounts for the year appear below:  The company paid a cash dividend of $36,000 and it did not dispose of any long-term investments or property, plant, and equipment. The company did not issue any bonds payable or repurchase any of its own common stock. The following questions pertain to the company's statement of cash flows. The net cash provided by (used in) operating activities last year was:

The company paid a cash dividend of $36,000 and it did not dispose of any long-term investments or property, plant, and equipment. The company did not issue any bonds payable or repurchase any of its own common stock. The following questions pertain to the company's statement of cash flows. The net cash provided by (used in) operating activities last year was:

Definitions:

Straight-Line Depreciation

An arrangement for allocating the cost of a tangible asset over its duration of usefulness in identical annual segments.

Discount Rate

The interest rate charged to commercial banks and other depository institutions by the central bank for loans received from the central bank's discount window; it is also used in discounted cash flow analysis to determine the present value of future cash flows.

Payback Period

The duration required for an investment to recoup its initial outlay in terms of profits or savings.

Initial Investment

The amount of money used to start a project, business, or investment, often encompassing costs such as capital expenditures and working capital.

Q22: Kari Kennel uses tenant-days as its measure

Q32: In the payback method, depreciation is deducted

Q38: Symons Corporation has provided the following financial

Q87: Hysong Corporation uses residual income to evaluate

Q95: Burdick Corporation has provided the following financial

Q109: Schepp Corporation has provided the following financial

Q110: When used in return on investment (ROI)

Q259: Macmillan Corporation has provided the following financial

Q287: Burdick Corporation has provided the following financial

Q317: Bobe Air uses two measures of activity,