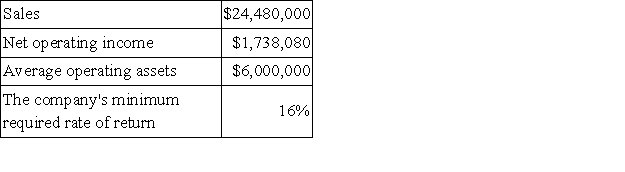

Faas Wares is a division of a major corporation. The following data are for the latest year of operations:  Required:

Required:

a. What is the division's return on investment (ROI)?

b. What is the division's residual income?

Definitions:

Health Savings Account

An account that allows individuals with high-deductible health plans to save money tax-free for medical expenses.

Out-Of-Pocket Expenses

Costs that an individual must pay out of their own cash reserves, including medical expenses, business expenses not reimbursed, and other personal expenditures.

Self-Employed Health Insurance

A deduction that allows self-employed individuals to deduct 100% of their health insurance premiums from their taxable income.

AGI Deduction

Reductions from gross income that lower an individual's taxable income, based on specific expenses and contributions.

Q60: Morrish Inc. bases its manufacturing overhead budget

Q100: Average operating assets is used in the

Q106: The most recent balance sheet and income

Q231: Stitt Corporation manufactures and sells a single

Q245: Sperle Corporation has provided the following data

Q268: The Maxwell Corporation has a standard costing

Q299: Chirico Clinic uses client-visits as its measure

Q357: Gilder Corporation makes a product with the

Q384: Kowaleski Corporation makes a product with the

Q387: Mcindoe Clinic bases its budgets on the