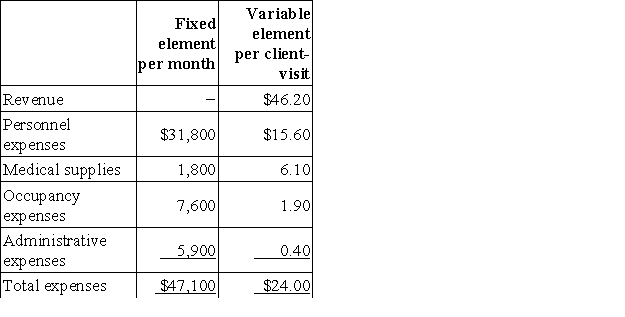

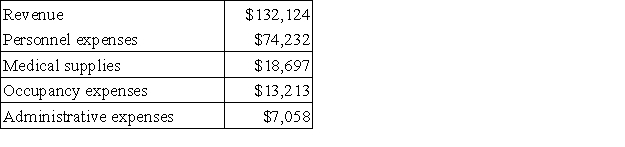

Buonocore Clinic uses client-visits as its measure of activity. During August, the clinic budgeted for 2,800 client-visits, but its actual level of activity was 2,770 client-visits. The clinic has provided the following data concerning the formulas used in its budgeting and its actual results for August: Data used in budgeting:  Actual results for August:

Actual results for August:  The spending variance for medical supplies in August would be closest to:

The spending variance for medical supplies in August would be closest to:

Definitions:

Security Pairs

A strategy in trading involving two closely related securities, where one is purchased (long position) and the other is sold (short position).

Index Model

A statistical model used to represent the returns of a financial market index, essentially simplifying securities analysis by correlating a particular stock or portfolio's performance to a broader market benchmark.

Regression Equation

A mathematical formula used to predict the value of a dependent variable based on the values of one or more independent variables.

Beta

A measure of a stock's volatility in relation to the overall market; a beta greater than 1 indicates the stock is more volatile than the market, while a beta less than 1 indicates less volatility.

Q41: Crow Corporation produces a single product and

Q49: Novelli Corporation makes a product whose variable

Q54: Cicchetti Corporation uses customers served as its

Q60: Jason Corporation has invested in a machine

Q154: The Gerald Corporation makes and sells a

Q180: Tysor Framing's cost formula for its supplies

Q183: Graybeal Corporation makes a product with the

Q205: The following data have been provided by

Q296: Labombard Clinic uses client-visits as its measure

Q386: A manufacturing company that has only one